Click here to download P3 Financial Bulletin

Weekly Market Forecast: 21st – 27th May 2018

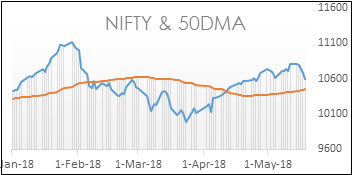

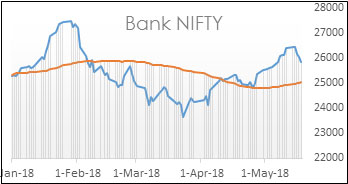

The market turned negative sharply and ended in RED on both Thursday and Friday. The NIFTY closed at 10596.4 (10806.50) down 1.94% for the week. BANK NIFTY followed NIFTY. It closed at 25875.6 (26413.5) for the week, down 2.04%. Both BSE Midcap and BSE Smallcap indices continued to remain bearish for 3rd week in a row. BSE Midcap closed at 15895.68 (16343.99) down 2.74%, and BSE Smallcap also closed in red at 17326.78 (17818.09) down by 2.76%. However, the monthly trend for the broader Indian markets continues to be bullish. In the coming week, market movement will continue to be guided by Q4 results. Some of the key ones to look for are SBI, Tata Motors, Indian Oil, Grasim, Cipla, etc.

Global markets snapped last week’s up move. The US bourses closed in RED. Dow closed at 24715.09 down 0.46% for the week. Both S&P 500 NASDAQ too closed in RED down similar to Dow Jones.

Both Gold and Silver closed negative for the week. MCX Gold Mini futures closed at 31087, down 1.42%, MCX Silver Mini futures closed at 40194 down by about 0.95%.

Crude oil prices moved up further consecutively for the 6th week. MCX CRUDE may futures closed at 4859 up by 1.3% for the week and 6% for the month.

This week, INR further depreciated against US dollar. USD/INR closed at 68.0150 against last week’s 67.3300, USD was up by 1.02%.

Hindustan Unilever: Reported strong results. Sales was up at INR 9097 cr. for the quarter compared to INR 8906 cr., the period last year. EBITDA was up 24% YoY and EBITDA margin expanded by 160 bps. Net profit jumped by 14%. This reflected in the stock price movement and HUL ended at 52-week high of 1605.80 on Friday up by a strong 6.76% for the week.

Events in the week:

- Monday 21 May – OPEC meeting (tentative)

- Tuesday 22 May – US API Crude oil stock,

- Wednesday 23 May – US Manufacturing PMI (May), New Home Sales, Crude oil inventories

- Thursday 24 May – US Existing home sales (Apr)

- Friday 25 May – India Bank deposit & loan growth, US Core durable goods order, Fed Chair’s address

The result calendar

- Monday: Colgate, DLF, Bank of India

- Tuesday: Cipla, Bharat Forge, HPCL, IOC, SBI

- Wednesday: Grasim, Motherson Sumi, Tata Motors

Trading Ideas: Based on technical analysis, we recommend the following trades for the week:

1. HDFC Bank: Buy @ 1996.05; StopLoss 1990.45; Target 2007.25

2. Reliance Ind: Buy @ 936.75; StopLoss 926.45; Target 967.70

Last week’s Technical Call:

1. IOC: Buy @ 168.25; StopLoss 167.50; Target1 169.75, Target2 171.25: Both Targets HIT

2. TATA CHEM: Buy @ 742.50; StopLoss 732.10; Target 773.40: Stoploss Triggered

Credit- Dr Amiya Sahu

Bond market update

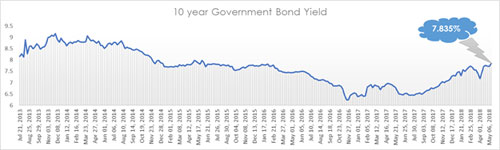

Bond yields rose by about 11 basis points (up by 1.41%) during the week closing at 7.835%.

Rising bond yields are a deterrent to the government borrowing plan as the expenditure is set to rise, but finance ministry officials have informed about continuing their borrowing plan despite the rise in the yields. RBI on the other hand is working towards cooling the yields, it has already made an announcement to buyback the bonds.

For Investors willing to earn better returns from the debt market, this would be the right time investing in bonds. The AAA bond yields have reached 8.3% as compared to fixed deposit interest rates of 6.5-6.75%.

Investment Series 4: - Investing money is great, but where do I invest?

Investments are important towards fulfillment of one’s financial goals but investing in the right products holds the key to achieving the goals sometimes even better them. Most of the individuals in today’s scenario have investments in their portfolio maximum of it in the form of PF, FDs, Insurance etc. But the world doesn’t end here, there are many other investment options available to an individual today from which he/she can choose. In this article we will try to identify each of them.

Investments are important towards fulfillment of one’s financial goals but investing in the right products holds the key to achieving the goals sometimes even better them. Most of the individuals in today’s scenario have investments in their portfolio maximum of it in the form of PF, FDs, Insurance etc. But the world doesn’t end here, there are many other investment options available to an individual today from which he/she can choose. In this article we will try to identify each of them.

As we know by now that there are three broad asset classes where one can invest in which are (1) Equity (2) Debt and (3) cash, in addition to this there are other asset classes like Real estate and gold. The proportion of allocation in each of the asset classes is decided based on one’s risk profile of the individual. But all said and done, the problem here lies in knowing which product to invest in. In today’s world the individual has a plethora of products available at his disposal where he/she can invest in, but most of the individuals are unaware of them. Let us identify the products available one by one based on their asset classes.

Equity asset class

1) Direct Equity

a. Large cap

b. Mid cap

c. Small cap

d. Penny stocks

2) Equity Mutual funds

a. Large cap fund

b. Large+mid fund

c. Small cap fund

d. Multicap fund

e. Tax saver fund

f. Sector fund

g. Contra fund

h. Focused fund

i. Value fund

j. Divided yield fund

k. ETF

l. Index funds

Debt Asset class

1) Debt Mutual Funds

a. Liquid fund

b. Ultra-short-term fund

c. Low duration fund

d. Money market fund

e. Short term duration fund

f. Medium duration fund

g. Medium- long term duration fund

h. Long term duration fund

i. Dynamic bond fund

j. Corporate bond fund

k. Credit opportunities fund

l. Banking and PSU fund

m. Gilt fund

n. Floater fund

2) Bonds

a. Taxable

b. Tax free

3) PF

4) PPF

5) Fixed deposit

a. Normal FD

b. Tax saver FD

6) NSC

7) Recurring deposit

8) Post office saving

9) Senior citizen saving scheme

10) Pradhan Mantri Vaya Vandana Yojana (60 plus years)

Other products

1) Hybrid mutual fund

a. Equity hybrid

b. Balanced

c. Debt hybrid

2) National Pension System (NPS)

3) Insurance

a. Normal endowment

b. Money back

c. Unit linked Insurance plan (ULIP)

Real Estate

1) Commercial

2) Residential

Gold

1) Physical gold

2) Gold Bonds

3) Gold ETF

From next week onwards, we will be discussing on each of the products in detail and understand how to invest in these products.