Click here to download P3 Financial Bulletin

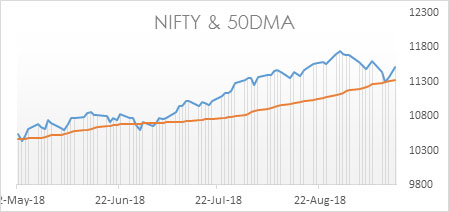

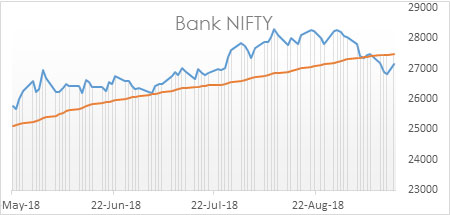

Weekly Market Forecast: 17th September to 23rd September 2018 The Indians market were in red for the second week, though strong bounce back was seen in last two trading days of the shortened week due to Ganesh festivals. The NIFTY, closed in red at 11515.20 (11589.10 last week) down by 0.64%. The BANK NIFTY, also corrected and closed at 27163.85 (27481.75 last week), weaker than NIFTY and down by 1.16%. Both BSE Midcap and BSE Smallcap also corrected in line with the market index. Midcap Index closed at 16349.97 (16504.86 last week) with a loss of 0.94%. BSE Smallcap index closed at 16670.93 (16896.95 last week) weaker by 1.34%.

The bullish trend continues for the broader market on a monthly basis. A watch on Indian macro data with some positive numbers last week and movement of Indian rupee and crude prices are to be watched. Global events will also be crucial.

The US bourses bounced into the green zone. Dow Jones Industrial Average (DOW) closed at 26154.67 (25916.3 last week) stronger by 0.88%. S&P 500 closed at 2904.98 (2871.68 last week) up by 1.16%. NASDAQ closed at 8010.04 (7902.45 last week) up by 1.36%.

Both the shiny metals, Gold and Silver closed in red for the week. MCX Gold Mini 05 October Futures closed at 30,450 (30,522 last week) weaker by 0.24%. MCX Silver Mini 30 Nov Futures closed at 37,029 (37,234 last week) down by 0.55%.

Crude oil rebounded. MCX Crude oil 19 Sep Futures closed at 4956 (4882 last week) up by 1.5%.

The Indian Rupee ended flat in the week. USD/INR depreciated further below 73 mark but rebounded later in the week. It closed on Friday at 72.105 compared to previous week’s close of 72.100.

Events in the week:

- Monday 17 Sep – US NY Empire state manufacturing index

- Tuesday 18 Sep– OPEC Meeting; US data on JOLTs Job opening

- Wednesday 19 Sep – US Building permits, Housing Statistics; Crude oil inventories

- Thursday 20 Sep – India Holiday; US initial jobless claims, Philadelphia Fed manufacturing index, Existing Home sales

- Friday 21 Sep – India Forex reserves; US Manufacturing PMI

Trading Ideas: Based on technical analysis, we recommend the following trades for the week:

1. Power Grid: Buy @ 194.55; StopLoss 192.95; Target 197.75

2. Aurobindo Pharma: Buy @ 738.55; StopLoss 724.50; Target 766.65

Last week’s Technical Call:

1. Hero Motocorp: Sell @ 3439.55; StopLoss 3495.50; Target 3297.55…did not reach price level

2. M&M: Buy @ 949.35; StopLoss 932.25; Target 983.75…stoploss triggered

3. Titan: Buy @ 865.85; StopLoss 848.10; Target 901.45….stoploss triggered

Weekly Top Gainers/ Losers (NIFTY)

| Top Gainers | Top Losers | |||

| Name of Company | Weekly Return | Name of Company | Weekly Return | |

| Grasim | 3.74% | Hero Motocorp | - 4.29% | |

| UPL | 3.19% | Tata Motors | - 3.89% | |

| NTPC | 3.18% | Coal India | - 3.21% | |

| Eicher | 2.45% | Titan | - 2.86% | |

| Vedanta | 2.32% | Bajaj Finance | - 2.62% | |

Credit- Dr Amiya Sahu

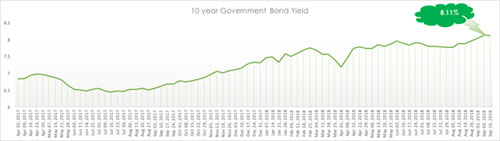

Bond market update

Bond yields remained flat for the week, it moved marginally down (down by 0.21 %) during the week closing at 8.11%. The rise in yields is on account of rupee depreciation touching 72-mark last week amid concerns with the emerging markets, rising oil prices amid sanctions on Iran and trade war.