Click here to download P3 Financial Bulletin

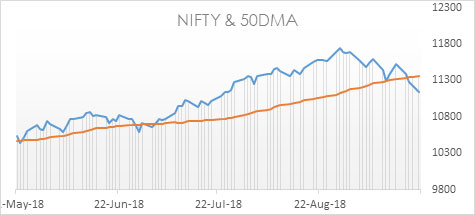

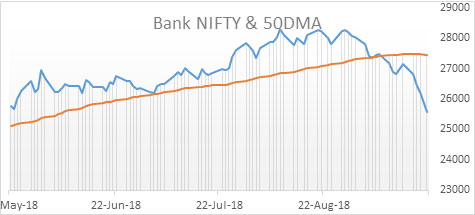

Weekly Market Forecast: 24th September to 30th September 2018 The Indians market were in red for the third week in a row. Panic was seen in the second half of Friday as news of debt market defaults by IL&FS prevailed. The NIFTY, closed in red at 11143.10 (11515.20 last week) down by a huge 3.23%. The BANK NIFTY, also dived down and closed at 25596.90 (27163.85 last week), weaker by 5.77%. Both BSE Midcap and BSE Smallcap also ended deep in red. Midcap Index closed at 15595.63 (16349.97 last week) with a loss of 4.64%. BSE Smallcap index closed at 15763.10 (16670.93 last week) weaker by 5.45%.

The market direction has turned negative and you need to trade with caution. Its better stay away from trading the indices. A watch on Indian macro data, exchange rate and crude prices are to be watched. Global events will also be crucial. Any negative will trigger more panic.

The US bourses continued their bullish move, mainly DOW. Dow Jones Industrial Average (DOW) closed at 26743.50 (26154.67 last week) stronger by 2.25%. S&P 500 closed at 2929.65 (2904.98 last week) up by 0.85%. NASDAQ, however, closed in red at 7986.96 (8010.04 last week) down by 0.29%.

Both the shiny metals, Gold and Silver closed in green for the week. MCX Gold Mini 05 October Futures closed at 30,610 (30,450 last week) stronger by 0.53%. MCX Silver Mini 30 Nov Futures closed at 37,600 (37,029 last week) up by 1.54%.

Crude oil rebounded. MCX Crude oil 19 Oct Futures closed at 5146 (4950 last week) up by 3.96%.

The Indian Rupee ended flat in the week. USD/INR depreciated further below 73 mark but rebounded later in the week. It closed on Friday at 72.215 compared to last week’s close of 72.105.

Events in the week:

- Monday 24 Sep – China holiday; US treasury bill auctions

- Tuesday 25 Sep– US CB Consumer confidence

- Wednesday 26 Sep – India M3 money supply; US New home sales, Crude oil inventories, FOMC economic projections

- Thursday 27 Sep – OPEC Meeting; US Core durables goods order, GDP, Pending home sales

- Friday 28 Sep – India Fiscal deficit, Bank data, Infrastructure output; US Personal spending,

Trading Ideas: Based on technical analysis, we recommend the following trades for the week:

1. Asian Paints: Sell @ 1352.9; StopLoss 1374.05; Target 1310.90

2. Hero Motocorp: Sell @ 3262.30; StopLoss 3300.90; Target 3183.00

Last week’s Technical Call:

1. Power Grid: Buy @ 194.55; StopLoss 192.95; Target 197.75…did not reach price level

2. Aurobindo Pharma: Buy @ 738.55; StopLoss 724.50; Target 766.65…stop loss triggered

Weekly Top Gainers/ Losers (NIFTY)

| Top Gainers | Top Losers | |||

| Name of Company | Weekly Return | Name of Company | Weekly Return | |

| BPCL | + 6.21% | Yes Bank | - 29.90% | |

| GAIL | + 5.46% | India Bulls HF | - 13.44% | |

| ONGC | + 4.55% | Bajaj Finance | - 10.96% | |

| Bharti Infratel | + 2.40% | UPL | - 9.63% | |

| HPCL | + 2.12% | Lupin | - 8.10% | |

Credit- Dr Amiya Sahu

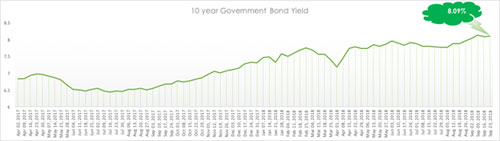

Bond market update

Bond yields remained flat for the week, it moved marginally up by about 2 basis points (up by 0.26 %) during the week closing at 8.09%.