Click here to download P3 Financial Bulletin

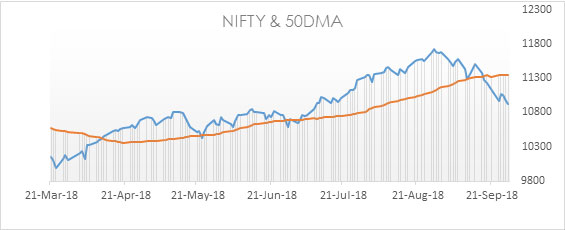

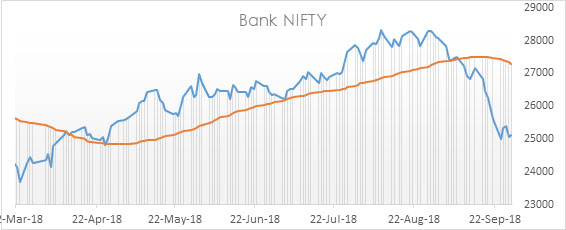

Weekly Market Forecast: 1st October to 7th October 2018 The Indians market were in red again for the fourth consecutive week and also for the month of September. Panic was seen in again in certain stocks as they nosedived in the week. The NIFTY, closed in red at 11143.10 (11515.20 last week) down by 1.91% for the week and 6.4% for the month. The BANK NIFTY, also dived down further and closed at 25596.90 (27163.85 last week), weaker by 1.86% for the week and 10.5% for the month. Both BSE Midcap and BSE Smallcap followed the leading indices. Midcap Index closed at 14763.20 (15595.63 last week) with a loss of 5.34%. BSE Smallcap index closed at 14430.68 (15763.10 last week) weaker by 8.45%.

The market direction has turned negative and you need to trade with caution. A watch on interest rate decision, exchange rate and crude prices is advised. Global events will also be crucial.

The US bourses were subdued for the week. Dow Jones Industrial Average (DOW) closed at 26458.31 (26743.50 last week) weaker by 1.07%. S&P 500 closed at 2913.98 (2929.65 last week) down by 0.53%. NASDAQ, however, closed in green at 8046.35 (7986.96 last week) up by 0.74%.

Both the shiny metals had wild swings during the week. Gold prices corrected while sliver moved up. MCX Gold Mini 05 October Futures closed at 30,500 (30,610 last week) weaker by 0.33%. MCX Silver Mini 30 Nov Futures closed at 38,610 (37,600 last week) up by 2.69%.

Crude oil moved up further in the week. MCX Crude oil 19 Oct Futures closed at 5335 (5146) up by 3.67%.

The Indian Rupee depreciated in the week. USD/INR traded above 72 mark for all trading days in the week. It closed on Friday at 72.515 compared to last week’s close of 72.215.

Events in the week:

- Monday 01 Oct – China holiday; US Manufacturing PMI,

- Tuesday 02 Oct– India holiday; China holiday; US Fed announcements

- Wednesday 03 Oct – China holiday; Nonfarm employment change; Non manufacturing PMI, US Crude oil inventories

- Thursday 04 Oct – China holiday; India Interest rate decision (else on Friday); US Initial jobless claims,

- Friday 05 Oct – China holiday; India Interest rate decisions (if not on Thursday); US data on Payrolls, Unemployment rate, Trade balance

Last week’s Technical Call:

1. Asian Paints: Sell @ 1352.9; StopLoss 1374.05; Target 1310.90…price level did not reach

2. Hero Motocorp: Sell @ 3262.30; StopLoss 3300.90; Target 3183.00…price level did not reach

Weekly Top Gainers/ Losers (NIFTY)

| Top Gainers | Top Losers | |||

| Name of Company | Weekly Return | Name of Company | Weekly Return | |

| TCS | 3.83% | Indiabulls HF | - 19.33% | |

| Infosys | 3.51% | Yes Bank | - 18.92% | |

| Reliance Industries | 3.32% | Eicher Motor | - 13.44% | |

| Axis Bank | 2.34% | Tata Motor | - 10.65% | |

| HDFC Bank | 1.82% | M&M | - 10.31% | |

Monthly (August, 2018) Top Gainers/ Losers (NIFTY)

| Top Gainers | Top Losers | |||

| Name of Company | Weekly Return | Name of Company | Weekly Return | |

| Wipro | 9.18% | Yes Bank | - 49.71% | |

| Dr. Reddy’s | 6.16% | Indiabulls HF | - 33.09% | |

| TCS | 5.39% | Bajaj Finance | - 27.38% | |

| HCL | 5.32% | Maruti Suzuki | - 21.56% | |

| BPCL | 3.44% | Adani Port | - 14.77% | |

Credit- Dr Amiya Sahu

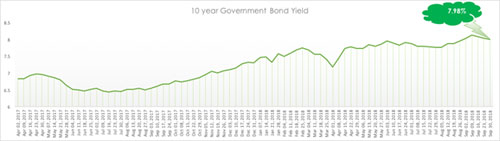

Bond market update

Bond yields are showing signs of retreat, it moved marginally down by about 4 basis points (down by 0.45 %) during the week closing at 7.98%.

The reason for this retreat is due to governments borrowing target reduction by 700 billion rupees and RBI plans to pump in 360 billion rupees through OMO (open market operations). The news of RBIs OMO followed the news by the government to borrow a total of 2.47 trillion as against the earlier 34.08 trillion, lower than its budgeted estimates.