Click here to download P3 Financial Bulletin

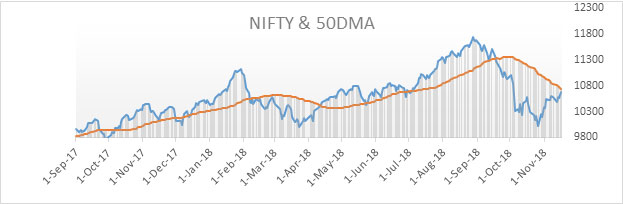

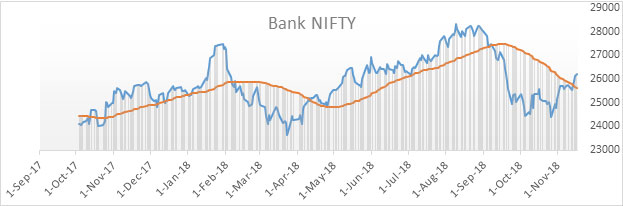

Weekly Market Forecast: 19th November to 25th November The Indians market ended with a strong gain in the week. The NIFTY, closed at 10,682.20 (10,585.20 last week) up by a strong 1.91%. The BANK NIFTY, also had a strong up move and closed at 26,245.55 (25,771 last week), stronger by 2.76% for the week. While BSE Midcap ended in green, BSE Smallcap index was subdued. Midcap Index closed at 14,997.81 (14944.20 last week) with a gain of 0.35%. BSE Smallcap index closed at 14,485.88 (14671.85 last week) weaker by 1.27%.

The market made a strong positive move which is expected to extend further. A strong resistance can be observed the range of 10930 – 11035. A correction is expected from this level. Strength of Indian rupee against USD, and Crude oil prices will play a key role. On the political front, elections in the big states could affect sentiments.

The US bourses ended in negative territory after two weeks of positive moves. Dow Jones Industrial Average (DOW) closed at 24,413.22 (25,989.30 last week) weaker by a 2.21%. S&P 500 closed at 2736.27 (2781.01 (2723.06 last week) down by 1.61%. NASDAQ too closed in red at 7247.87 (7406.90 last week) weaker by 2.17%.

The shiny metals closed flat. MCX Gold Mini 05 December Futures closed at 31,012 (31,023 last week) weaker by 0.03%. MCX Silver Mini 30 Nov Futures closed at 37,002 (36,910 last week) up by 0.25%.

The bearish movement of Crude oil price extended for the 6th week. MCX Crude oil 18 Dec. Futures closed at4104 (4363 last week) down by a strong 5.96%.

The Indian Rupee’s appreciation continued for the second week. USD/INR closed on Friday at 71.9250 compared to last week’s close of 72.4950.

Events in the week:

- Monday 19 Nov – US t-bill auctions

- Tuesday 20 Nov – US data on Housing & building permits

- Wednesday 21 Nov – India data on Money supply; US Core durable goods order, Initial jobless claims, Crude oil inventories

- Thursday 22 Nov – US holiday

- Friday 23 Nov –India holiday; US Manufacturing PMI, Services PMI

Trading Ideas: Based on technical analysis, we recommend the following trades for the week:

1. Reliance: Sell @ 1160.55; StopLoss 1182.05; Target 1117.65

2. Bajaj Finance: Sell @ 2437.00; StopLoss 2482.15; Target 2345.95

Performance of Last week’s Technical Call:

1. Grasim: Sell @ 873.55; StopLoss 886.45; Target 834.75…stop loss HIT

2. TCS: Buy @ 1894.70; StopLoss 1883.65; Target 1916.80…stop loss HIT

Weekly Top Gainers/ Losers (NIFTY)

| Top Gainers | Top Losers | |||

| Name of Company | Weekly Return | Name of Company | Weekly Return | |

| Bharti Airtel | 11.01% | Yes Bank | - 16.19% | |

| Eicher | 9.96% | Sun Pharma | - 13.01% | |

| Titan | 8.69% | Indiabulls HF | - 11.13% | |

| BPCL | 8.49% | Tata Motors | - 7.86% | |

| UPL | 4.30% | GAIL | - 6.85% | |

Credit- Dr Amiya Sahu

Bond market update

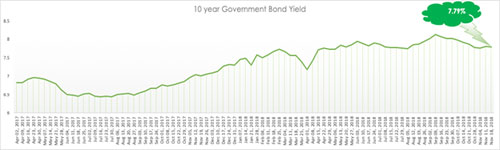

Bond yields cooled off marginally from its last week’s rise, it moved down by about 2 basis points (down by 0.29 %) during the past week closing at 7.79%.

The cooling of bond yields is mainly on account of falling oil prices which is now trading below the $65 mark. This fall has in turn helped the Indian macros as seen in appreciation of the currency.

The bond yields of 7.79% in fact offer a good return on the investment front when compared to FDs. The government yields being the safest of the lot offer 7.79%, the second on the list being AAA rated securities offering 8% plus returns. This coupled with the taxation benefit it brings makes these investments a lucrative choice.