Click here to download P3 Financial Bulletin

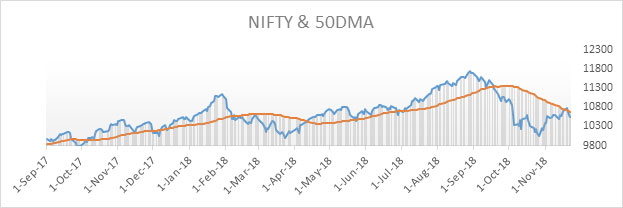

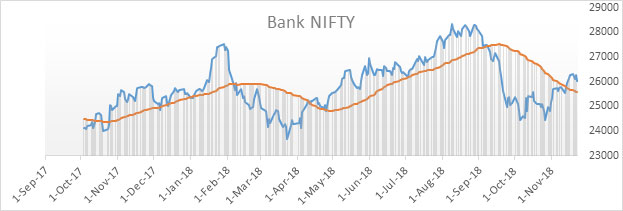

Weekly Market Forecast: 26th November to 2nd December The Indians market ended weaker after three weeks of bulling movement. The NIFTY, closed at 10,526.75 (10,682.20 last week) down by a 1.46%. The BANK NIFTY, also closed negative at 25,999.45 (26,245.55 last week), weaker by 0.94 for the week. Both BSE Midcap and BSE Smallcap index were subdued too. Midcap Index closed at 14880.34 (14,997.81 last week) with a loss of 0.71%. BSE Smallcap index closed at 14,350.84 (14,485.88 last week) weaker by 0.93%.

The market (NIFTY) made a strong negative move, from a close by resistance level 10810. Reversal may be seen if the rupee maintains its level against dollar and Crude oil prices do not spike. On the political front, elections in the big states may continue to affect sentiments.

The US bourses ended in negative territory for the 2nd weeks in a row. A strong bearish move was seen in the US bourses, the weakest since March 2018. Dow Jones Industrial Average (DOW) closed at 24,285.95 (25,413.22 last week) weaker by a 4.43%. S&P 500 closed at 2632.56 (2736.27 last week) down by 3.79%. NASDAQ too closed in red at 6938.98 (7247.87 last week) weaker by 4.26%.

The US bourses ended in negative territory for the 2nd weeks in a row. A strong bearish move was seen in the US bourses, the weakest since March 2018. Dow Jones Industrial Average (DOW) closed at 24,285.95 (25,413.22 last week) weaker by a 4.43%. S&P 500 closed at 2632.56 (2736.27 last week) down by 3.79%. NASDAQ too closed in red at 6938.98 (7247.87 last week) weaker by 4.26%.

The shiny metals too ended in the red zone. MCX Gold Mini 05 December Futures closed at 30,513 (31,012 last week) weaker by 1.61%. MCX Silver Mini 30 Nov Futures closed at 36,120 (37,002 last week) down by 2.38%.

The bearish movement of Crude oil price extended for the 7th week. MCX Crude oil 18 Dec. Futures closed at 3623 (4104 last week) down by 11.27%, one of the sharpest falls in many years. Crude is down more than 30% since its peak on 3rd October 2018.

The Indian Rupee’s appreciation continued for the third week. USD/INR closed on Friday at 70.6900 compared to last week’s close of 71.9250.

Events in the week:

- Monday 26 Nov – US T-bill auctions

- Tuesday 27 Nov – US CB Consumer confidence

- Wednesday 28 Nov – US data on GDP, Goods trade balance, New home sales, Crude oil inventories

- Thursday 29 Nov – US Core PCE price Index, Personal income & spending, Pending home sales

- Friday 30 Nov – India GDP quarterly data, Fiscal deficit, Infra. Output; China Manufacturing & non-manufacturing PMI; US Chicago PMI

Trading Ideas: Based on technical analysis, we recommend the following trades for the week:

1. LIC HF: Sell @ 458.70; StopLoss 474.30; Target 427.35

Performance of Last week’s Technical Call:

1. Reliance: Sell @ 1160.55; StopLoss 1182.05; Target 1117.65…missed entry by 5 rupees…target HIT

2. Bajaj Finance: Sell @ 2437.00; StopLoss 2482.15; Target 2345.95…Target HIT

Weekly Top Gainers/ Losers (NIFTY)

| Top Gainers | Top Losers | |||

| Name of Company | Weekly Return | Name of Company | Weekly Return | |

| Adani Port | 5.96% | Indiabulls HF | - 7.90% | |

| Dr. Reddy’s | 5.31% | Tata Steel | - 6.00% | |

| Zee Entn. | 3.44% | Wipro | - 5.86% | |

| Yes Bank | 2.38% | NTPC | - 5.23% | |

| Indusind Bank | 1.85% | Hindalco | - 5.15% | |

Credit- Dr Amiya Sahu

Bond market update

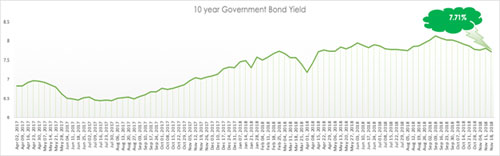

Bond yields cooled off further, it moved down by about 8 basis points (down by 1 %) during the past week closing at 7.71%.

The bond yields have been cooling due to the falling crude, strengthening of rupee and also mainly due to the OMO operations by RBI. Till date RBI has brought Rs 1280 billion of bonds through OMO, for the month of December RBI is planning to buy Rs 400 billion worth of bonds.