Click here to download P3 Financial Bulletin

Weekly Market Forecast: 16 – 20 April 2018

The week ended in green for the market. The NIFTY index closed at 10480.60 up 1.44% for the week and 3.63% since end of March. The BANK NIFTY also followed the boarder market index and closed at 25200.6 up by 1.32% for the week and 3.86% since end of March. The BSE Midcap index closed at 16677.76 up 0.49%, and BSE Small cap closed at 17982 up 0.55%. Although the monthly trend for the broader Indian markets is bullish, we advise to trade with caution in this week of financial results and expected more exposures of banking frauds.

Global markets have become volatile due to trade-war tensions between China & US. The US bourses closed in RED on Friday. Dow Jones fell 122.91 points for the day. NASDAQ and S&P 500 followed Dow and fell by 0.43% and 0.81% respectively.

In the next week, data on WPI index will have some effect on the market as it expected to be marginally higher 2.58% compared to 2.48% on a YoY basis.

Infosys Results: Infosys posted its Q4 results on Friday 13th April, 2018. It reported a revenue growth of 5.6% on Y0Y basis to INR 18,083 crores and only 1.6% on QoQ basis. The operating profit reported was INR 4,472 crores up by 6.2% compared to the previous year and by 3.5% on QoQ. The net profit reported was INR 3,690 crore which grew by 2.4% on YoY basis but it fell by 28.1% on sequential basis.

Infosys’ share price closed at INR 1171.45, up 0.7% on Friday (NSE), its ADR listed on NASDQ closed negative 7.72% at USD 16.62. A guidance of lower profit margins and softer revenue growth for FY19 could be the reason behind the sharp fall.

Events in the week:

- Macroeconomic data:

- Monday 12 noon: WPI Inflation - The result season has begun. The result calendar

- 16th - Monday: DCB Bank, RIL

- 17th – Tuesday: ACC, Mind Tree

- 19th – Thursday: TCS, IndusInd bank, Cyient

Trading Ideas: Based on technical analysis, we recommend the following trades for the week:

Lupin: BUY@ 747.55; Stop Loss 730.35; Target 799.15

LIC Housing Fin: BUY@ 524.45; Stop Loss 516.95; Target 547.05

Axis Bank: SELL@ 592.1; Stop Loss 611.6; Target 553.20

Investment Series 1: - Saving and Investing

Saving and Investing are two different aspects in the financial world, but most of the time we end up using them interchangeably. Lets understand what these two words mean, ‘Saving’ in simple terms means the amount of income that is kept aside for consumption on a later date for eg money put in piggy bank. ‘Investing’ on the other hands is putting these savings into aveneus which will help you grow your wealth. Everyone has to follow the latter approach with respect to their money they keep aside from their income for future consumption. I say this as there is a very important factor, which if not understood well can drain your wealth year on year. Yes, I am talking aboout Inflation. Inflation is general rise in prices of goods i.e in other words a fall in the purchasing value of money. If one doesn’t understand inflation well and how it impacts his or her finances then he/she is in serious trouble. Hence when I say one has to always follow an investing approach and not savings approach for the income kept aside for later consumption, I mean something very important here. Let me explain this a short example, let us assume an individual A has delayed his current expenditure on purchasing a bike by one year of an amount let say 1.2 lakhs. Now A has two options either to save the amount of 1.2 lakhs or invest it.

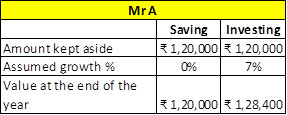

If Mr A chooses to save his 1.2 lakhs will remain as 1.2 lakhs at the end of the year, but if he chooses to invest the same his 1.2 lakhs will grow to 1.28 lakhs. From the above it is evident that Mr A is better of investing than saving.

Now let us understand the impact of inflation in the above example, lets assume that the inflation is close to 6% per annum. So as per the definition, we know that it is the rise in prices of goods, considering this impact the price of the bike at the end of one year will be 1.27 lakhs and not 1.2 lakhs. Hence, we can now see that If Mr A had chosen to save 1.2 lakhs, purchasing the bike would have to be deferred or he would have to allocate further funds from his income, whereas, if Mr A chose to invest then he would comfortably meet his objective and have a surplus of Rs 1000.

Thus, we can now see that investing is the right approach to be followed in all the cases as long as inflation exists.