Click here to download P3 Financial Bulletin

Weekly Market Forecast: 23 – 27 April 2018

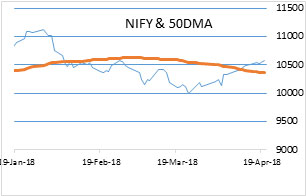

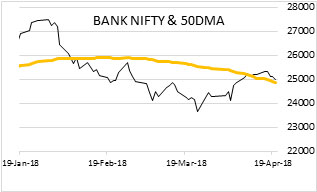

The market ended in green conductively for the fourth week. The NIFTY index closed at 10577.35 up 0.92% for the week. The BANK NIFTY closed weaker, as we had indicated last week expecting more exposures on banking frauds. It closed at 2500.50 down by 0.79% compared to previous week.

The BSE Midcap index closed at 16800.40 up 0.74%, and BSE Small cap closed at 18173.6 up 1.07%. The monthly trend for the broader Indian markets continues to be bullish. The next week market direction will be influenced by results of many heavy weights viz. Bharti Airtel, Ultratech, Wipro.

Global markets continued to be volatile. The US bourses closed in RED during the last three days of this week. Dow Jones fell by 396.1 points from the weekly high of 24858.97, a drop of 1.6%. NASDAQ and S&P 500 followed Dow and fell by 2.4% and 2.1% respectively from their weekly highs.

Gold & Silver inched up for a second week in a row. MCX Gold Mini futures has touched a high since October 2013. Gold Mini closed at 31330, up 0.95% for the week and 2.97% since 29th March 2018. Silver overshadowed gold price movements. MCX Silver Mini futures closed at 40497, up 4.09% for the week and 5.61% since 29th March.

Indian Rupee (INR) closed weaker, successively, for the second week. USD/INR closed at 66.207 on Friday, up 1.46% for the week.

TCS Results: TCS came out with its Q4 results on Thursday 19th April 2018 after the market hours. It reported highest growth in dollar revenue since last 14 quarters. This performance and 1:1 bonus fired the stock price as it closed at an all-time high of INR 3402.45 on Friday 20th April with a gain of 6.62% compared to the previous day.

Events in the week:

- Friday 27th April – Bank deposit & loan growth

The result calendar

- 23rd - Monday: Bharti Infratel, LICHF, Reliance Infra

- 24th – Tuesday: Bharti Airtel

- 25th – Wednesday: Ultra Teach, WIPRO, M&M Financial

- 26th – Thursday: Axis Bank, Yes Bank, Ambuja Cements, Biocon

- 27th – Friday: Maruti Suzuki, Shriram Transport, UPL

Trading Ideas: Based on technical analysis, we recommend the following trades for the week:

Wipro: BUY@ 293.7; Stop Loss 291.60; Target 297.95

L&T Fin Holdings: BUY@ 161.75; Stop Loss 159.2; Target 169.35

LIC Housing Fin: BUY@ 524.45; Stop Loss 516.95; Target 547.05

Cummins India: SELL@ 777.45; Stop Loss 791.90; Target 748.75

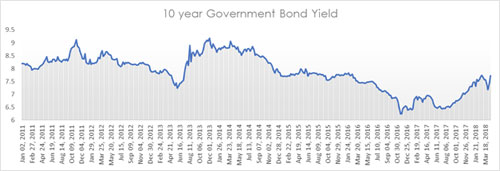

Bond market update

10-year govt bond yields have seen an increase by 8.3% (59 basis points) from its lowest on April 5th, with an increase of 3.3% (25 basis points) in last one week. The increase is mainly because of the minutes of RBI policy meeting that took place on 4-5th April which gave an indication of possible rise in interest rates by 25 basis points in June on account of upside risk of Inflation due to revival of growth, the impact of HRA increase by various state governments, rise in oil prices and increase in the MSP for formers.

Investment Series 2: - Plan your goals to achieve financial freedom

In our last article we understood the difference between saving and investing. In this article let us understand and try to answer these two most fundamental questions (1) why we need to save? and (2) how much does one need to save?

Saving is the most integral part of us in India, once we start earning, we keep some amount of corpus aside every month. All of us keep these funds from our income for achieving certain objectives we have in our mind which we want to achieve in our near future. These objectives are called goals. This answers the first question of why we need to save. Most of you all would be thinking, ‘duh! we knew this, what is the point in telling us what we already know’. I completely agree to the point made, but there is a purpose in repeating all this, let me explain. Most individuals are aware that they need to save/invest, but maximum of them are not aware of the goals for which they need to save/invest. The main reason for this, either we are not aware what all goals we need to plan for and what all things are to be considered while saving/investing to achieve these goals. This lacuna creates a void between what we actually save/invest and how much is actually needed. Let’s take some time and understand in brief about goals, an individual can have one goal or many goals for which he/she might be saving, and these goals can be short term or long term based on the time when we want to accomplish it. Few examples of goals would be,

Planning a Holiday |

Childs education |

Happy retired life |

Buying a car |

Owning a house |

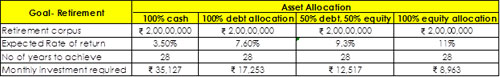

Once we have identified the goal, one needs to prioritize, allocate time frame, and finally assign value to these goals. So, he/she needs to list down all the goals he/she wants to achieve in his lifetime. This will undergo changes during various life phases (as requirement changes at critical juncture). This is a pre-requisite before we understand how much we need to save/invest. Once we have understood this, now let us understand how much we need to save/invest. To understand this let’s take an example. Let’s say our Mr. A, aged 30 wants to plan for his child’s education and retirement. Let us assume the corpus he wants to accumulate is 1 Cr* for his child’s education and 2 Cr* for his retirement, he has approx. 16 years and 28 years to achieve these goals respectively considering his child’s age being 3 years and his retirement age of 58 years. Mr. A is currently allocating ₹10,000 towards his child’s education and ₹10,000 towards retirement by investing in PPF/Endowment Insurance plans.

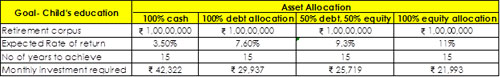

Below is the working of the amount that Mr. A requires to save/invest on monthly basis to achieve this goal. The working is done considering various asset allocation options.

# Equity returns assumed- 11%(last 17 years Sensex returns), Debt returns assumed- 7.6%(Considering tax saving investment like PPF, Debt MF etc.), Savings bank return- 3.5%

*Assumed in the example above. For exact calculation one needs to follow particular model which helps you understand the corpus required at future date considering the impact of inflation, one can contact his/her financial advisor to arrive at this figure.

So, from the above working the monthly saving/investment required is ₹ 29,937 for child’s education and from ₹ 17,253 for retirement based on the debt option followed by Mr. A. We can see that the amount being saved by Mr. A is not sufficient to meet the goals outlined, with his current investment of ₹ 10,000 each, he will be able to achieve only 0.33 Cr and 1.16 Cr respectively.

Finally, we can take away the following when we are planning our finances,

1) We need to save/invest to achieve future goals

2) List down all the goals, prioritize, allocate time frame and finally assign value.

3) Identify the amount that is required to achieve these goals through the asset allocation models that suits you (the above asset allocation combination are only sample combinations, one has to work the combination that actual suits him/her).

4) Calculate the monthly amount required to be saved/invested based on step 1,2 and 3 (If not aware, one will have to contact his/her financial advisor for this calculation)