Click here to download P3 Financial Bulletin

Weekly Market Forecast: 11th – 17th June 2018

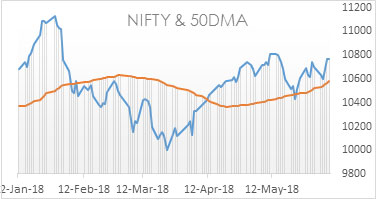

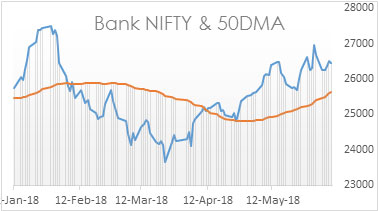

Last week again markets were volatile due to expectations around RBI’s interest rate policy. The NIFTY closed positive at 10767.65 (last week 10696.20) up by 0.67%. However, BANK NIFTY ended in RED and closed at 26451.35 (last week 26692.80) down by 0.90%. Both Midcap and Smallcap reacted to the volatility. BSE Midcap Index closed in Green at 16022.37 (last week 15851.51) and the BSE Smallcap index closed down at 16887.13 (last week 16978.96).

There is no change in the bullish trend of the broader market. In the coming week, market movement will be guided by Indian and global events.

The US bourses made a strong gain in the week ending 8th June. Dow closed at 25314.95 (last week 24635.21) up 2.76% for the week. Both S&P 500 and NASDAQ followed Dow and closed at 2779.03 and 7645.51 respectively.

Strong up move was seen in both Gold and Silver prices. MCX Gold Mini futures closed at 31085 (30568), up by 1.69%, MCX Silver Mini futures closed at 40460 (39572) stronger by 2.24%.

Crude oil gained marginally in the week reversing two weeks of correction. MCX Crude oil futures closed at 4448 (4419) up 0.66%.

This week, Indian Rupee depreciated against USD. USD/INR closed at 67.5115 compared to last week’s 67.4100.

Events in the week:

- Monday 11 Jun – China New Loans; US 10-Yr Note auction

- Tuesday 12 Jun – India Industrial Production (Apr), CPI (YoY for May); US Core CPI (MoM for May); China FDI

- Wednesday 13 Jun – US PPI (MoM for May), Crude oil Inventories, FOMC Economic projections, Fed Interest rate decisions

- Thursday 14 Jun – China Industrial Production (YoY for May); India WPI Inflation (YoY for May); US Retail sales (MoM for May), Initial Jobless claims

- Friday 15 Jun – India Forex reserves, Trade Balance; US Industrial Production (MoM for May)

Trading Ideas: Based on technical analysis, we recommend the following trades for the week:

1. Sun Pharma: Buy @ 494.20; StopLoss 483.80; Target 514.90

2. Dr. Reddy’s: Sell @ 2057.80; StopLoss 2074.50; Target 2007.50

3. Jet Airways: Sell @ 415.70; StopLoss 423.50; Target 400.15

Last week’s Technical Call:

There were errors in the charts. Hence, we had updated on them.

Credit- Dr Amiya Sahu

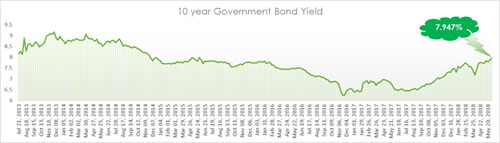

Bond market update

Bond yields rose by about 10 basis points (up by 1.26 %) during the week closing at 7.947% due to the monitory policy meeting of RBI held on 6th June where it changed its neutral stance.

The central bank increase in the repo rate by 25 basis points breaking its long held neutral stance. The central bank also increased its inflation forecast for the fiscal year 2018-19 to 4.8-4.9% for the first half and 4.7% in the second half of 2018-2019. In the previous policy review, RBI had predicted average inflation to be 4.7-5.1% for first half of the current fiscal and thereafter slow to 4.4% in the second half.

Investment Series 5: - Investing in Direct equity

Let us now start understanding the various investment products available in slight detail. We start our discussion with understanding direct equity as an investment product. Equity as we know is a stock or any other security having ownership interest in a company. Investing in direct equity enables a holder to be a shareholder of the company or in simple terms a partner in the company. The proportion of the partnership here is dependent on the number of equity shares the individual holds with respect to the total equity raised by the company. Shares like goods are bought and sold in the market place, these markets are call the share markets. There are two markets from where one can buy the shares (1) the primary market and (2) Secondary market. Let us understand both these markets

(1) Primary Markets: - Many of us must have heard the term IPO (Initial Public Offering) and FPO (Follow on Public Offering). IPO is the term used when firm issues equity shares for the first time in the market and FPO is when fresh shares are introduced for the second or third time in the market. In primary markets only buying of shares take place, selling is not possible in this market.

(2) Secondary Markets: - This is the market place where shares once issued in the primary markets can be bought and sold between investors. This market provides the liquidity to the equity shares. Just to refresh, liquidity means ability to be easily converted to cash.

Now that we have understood the markets, lets understand what a stock exchange is. Stock exchange is place where buying or selling of securities takes place like stocks, bonds, derivatives etc. In India there are many exchanges but the two which are most active are the Bombay stock exchange (BSE) and the National stock exchange (NSE). These markets have indicators which help in gauging the sentiment or direction of the equity market, these indicators are indices. The most talked about indices in these two exchanges are the Sensex in BSE and Nifty 50 in NSE. In addition to these there are many other indices which help in tracking the equity markets.

In order to understand investing in direct equity one needs to understand the different market capitalizations in which the stocks are segmented. Market capitalization is defined as market valuation of a company based on its total outstanding shares, in mathematical formula it is defined as the product of the current share price and the total no of outstanding shares. Stocks are categorized based on this market capitalization.

1) Large cap: - The top 100 companies based on the market capitalization are categorized as large cap

2) Mid cap: - The companies from 101 to 250 are categorized as mid cap

3) Small cap: - All the companies above 251 are categorized as small cap

If we were to define the riskiness of the above three categories, then large cap is the least risky followed by mid cap and finally the small cap. On the liquidity front the ranking remains the same with large cap being most liquid and the small caps being the least liquid. But on the returns front it is quite the opposite, the large cap gives the least return followed by mid cap and then the small caps.

In order to invest in direct equity, one needs to have three types of accounts

1) Savings bank account: - This account as we all know is to hold your funds (cash).

2) Trading account: - This account is mainly used to buy and sell shares. The amount from the savings bank needs to be allocated to this account to process the trades.

3) Demat account: - As the name suggests, this account is to hold the securities in dematerialized form. All the buying and selling of shares today happens electronically and are held in dematerialized form and not physical.

The first account the savings bank account as most of us are aware of needs to be opened in a bank, the second account which is the trading account needs to be opened with a broker. Investors cannot buy and sell directly in the exchange; the exchange appoints brokers who are authorized to do the buying and selling of equity shares. Finally, the demat account needs to be opened with the depository through depository participant. There are two depositories in India, the NSDL (National securities depository limited) and CDSL (Central depository services limited), these depositories appoint depository participants who will create demat account on their behalf. Brokers can also be a depository participant. Some brokers provide all the three accounts at one place like ICICI direct etc. or some provide only trading account and demat account together like Sharekhan etc. Once you have opened all the three accounts, one can start investing in equity shares.

In equity shares the returns are of two types (1) Capital appreciation through rise in share prices and (2) Dividend income based on the company policy. Although investing in direct equity can be rewarding with very high returns but the risks associated are also higher. In order to reap these benefits, one has to have thorough knowledge of understanding the company fundamentals, performance with respect to peers, Sector performance, Industry performance, the macroeconomic scenario and also understand the movement of markets and secondly one needs to have the risk appetite and courage to see high volatility in returns of his or her portfolio.

Finally, to end we would like to put across few words of caution, firstly one should not rely on the noise (Buy and Sell calls) or any friendly advice to invest in equity. Each one has to do his or her research and also analyze various analyst reports both the positive and negative in order to gauge the worthiness of the stock to buy or to sell. Second most important thing while investing in equity is timing the market, its impossible to time the market. No one can predict which will be the lowest point the market will fall to or which is peak, so never think of timing the market while investing in equity. One can only gauge the sentiment of the market while making his/her investments i.e. whether the market is bullish or bearish while making investing decisions.