Click here to download P3 Financial Bulletin

Weekly Market Forecast: 25th June – 1st July 2018

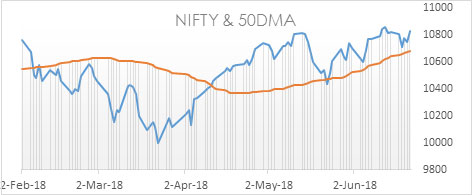

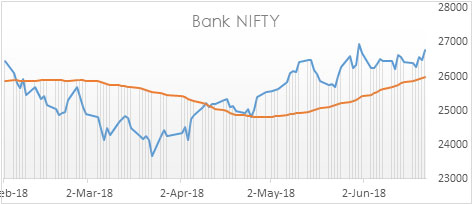

Indian broader market continued its bullish move for the 5th Week. The NIFTY closed flat for the week at 10821.85 (Last week 10817.70) up by 0.04%. The, BANK NIFTY reversed from being weak in last two weeks. It made a strong up move and at 26766.85 (last week 26417.40) up by 1.32%. Both Midcap and Small cap reacted in to the negative territory. BSE Midcap Index closed in RED at 15839.61 (last week 16001.20) and the BSE Small cap index also closed in RED at 16539.84 (last week16916.16).

The bullish trend continues of the broader market. In the coming week, market movement will be guided by Indian and global events.

The US bourses made deep cuts and closed in red again for the week ending 22nd June. Dow closed at 24580.89 (last week 25090.48) down 2.03%. Both S&P 500 and NASDAQ followed Dow and closed at 2754.88 (last week 2779.42) and 7692.82 (last week 7746.38) respectively.

Both the shiny metals corrected, further, in the week. MCX Gold Mini futures closed at 30,520 (last week 30819) down by 0.97%, MCX Silver Mini futures closed at 39809 (last week 40216) weaker by 1.01%.

Crude oil made sharp gains and was affected by OPEC decisions. MCX Crude oil futures closed at 4675 (last week 4432) up by 5.48%.

This week, Indian Rupee ended in green as it appreciated against USD. USD/INR closed at 67.8400 compared to last week’s 68.015.

Events in the week:

- Monday 25 Jun – US New Home Sales (May)

- Tuesday 26 Jun – US CB Consumer Confidence (Jun)

- Wednesday 27 Jun –US Core Durables Goods Order (MOM May), Pending Home sales (MoM May) Crude oil Inventories

- Thursday 29 Jun – US GDP (QoQ Q1), Initial Jobless claims

- Friday 29 Jun – India Fiscal deficit (May), Forex Reserves, Infrastructure output (YoY May), Foreign debt (Q1); US Personal Spending (MoM May), Chicago PMI (Jun), Michigan consumer Expectations (Jun)

Trading Ideas: Based on technical analysis, we recommend the following trades for the week:

1. Bank of Baroda: Sell @ 123.45; Stoploss 124.25; Target 121.85

2. SBI: Buy @ 269.30; Stoploss 268.35; Target 271.20

Last week’s Technical Call:

1. Infosys: Buy @ 1249.85; StopLoss 1239.95; Target 1270.60…stop loss triggered

2. HCL Tech: Buy @ 934.15; StopLoss 930.65; Target 941.15…stop loss triggered

3. Reliance Ind: Buy @ 975.45; StopLoss 958.95; Target1 1008.35, Target2 1025.15… price did not come to this level

Credit- Dr Amiya Sahu

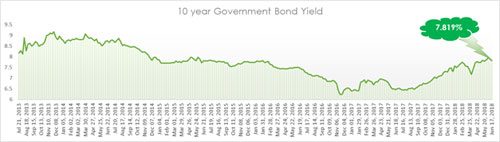

Bond market update

Bond yields fell by about 7 basis points (down by 0.89 %) during the week closing at 7.819% due to the RBI open market operation where it purchased Rs 100 billion worth of bonds from the secondary market.

Investment Series 6: - Investing in Equity Mutual fund

In our earlier article we spoke about investing in equity as an asset class through direct equity, in this article we will understand the second mode of investing in equity which is the mutual funds. In recent times we have seen and heard a lot about mutual funds through various mediums, one due to returns it has provided over the years as compared to other asset classes and the second being the awareness through the “Mutual fund sahi hai” campaign by AMFI (Association of Mutual Funds in India).

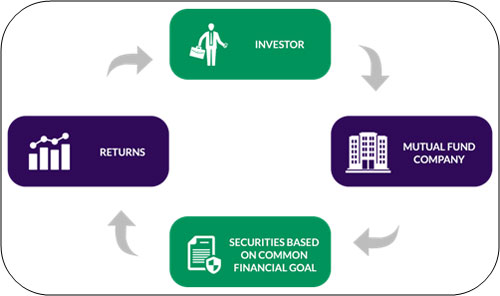

Mutual fund is a trust that collects money from a large number of investors who share a common objective, the fund here so formed is managed by a professional fund manager. The money collected in the fund is then invested across various securities like stocks, bonds, money market instruments and others based on the objective of the fund. The returns then generated from the investments are passed back to the investor deducting the expenses incurred in managing the fund.

Fig: Mutual fund flow chart

In equity mutual funds the investment in majorly in equity/shares of the companies, mostly in the range 30 to 50 plus. One can buy a mutual fund through purchasing of its units; these units are offered at NAV (Net asset value). NAV is the market value of all the shares held by the fund. The mutual fund is brought into the market through an NFO (New fund offer) where the units are offered at base price i.e. at NAV of ₹ 10, post this the NAV reflects the market value of the shares/equity it holds in its portfolio. The NAVs of all Mutual Fund schemes are declared at the end of the trading day after markets are closed, in accordance with SEBI Mutual Fund Regulations. The mutual fund performance is checked in comparison to the underlying benchmark, one responsibility of the fund manager is to provide better returns than the benchmark.

Mutual funds have variety of benefits in addition to the benefits of equity as an asset class (Liquidity, High returns, Taxation)

1) Professional fund management: - Each and every mutual fund is managed by a professional fund manager thus eliminating the need to selecting and investing in stocks directly.

2) Diversification: - Mutual funds invest in stock of various companies and not in a single one and also invests across sectors. Investing in such a fashion helps in diversifying the risk associated with equity to an extent.

3) Flexibility: - Investors have the flexibility of investing small sums of money every month through SIP (Systematic Investment Plan) or invest through lump sum route. One can choose from a wide range of schemes based on their objective. Mutual funds also offer switch (between funds) and withdrawal facility to redeem money as and when required.

4) Transparency: - Funds provide investors with information pertaining to the markets and schemes through factsheets, annual reports etc.

5) Well regulated: - Mutual funds in India are regulated by securities and exchange board of India (SEBI), which endeavors to protect the interests of investors. All funds are registered with SEBI and complete transparency is enforced. Mutual funds are required to provide investors with standard information about their investments, in addition to other disclosures like specific investments made by the scheme and the quantity of investment in each asset class.

6) Low transaction cost: -Due to economies of scale, mutual funds pay lower transaction costs. The benefits are passed on to mutual fund investors, which may not be enjoyed by an individual who enters the market directly.

Mutual funds are classified based on various structures

A) By Maturity

» Open ended: - This type of fund remains open and do not have a fixed maturity. The fund is open for investment even after the NFO by purchasing units are market value of NAV. The major benefit of open ended fund is liquidity where one can withdraw at any time.

» Closed ended: - Here the funds are for a specific period for ex 3 years. One can invest in the fund only during the NFO. The Amount here remains locked in for the period of the fund.

B) By Investment Objective

» Large cap fund: - Here the fund invests majorly in the large cap companies. As per SEBI, the first 100 companies in market capitalization are defined as large cap.

» Large + Mid cap fund: - Here the fund invests majorly in large cap and mid cap companies. The large cap are the first 100 companies, whereas mid cap is from 101st to 250th in market capitalization. The flexibility remains of investing remains with the fund manager based on this research and analysis.

» Mid cap fund: - Here the fund holding lies majorly in mid cap stocks i.e. from 101-250.

» Small cap fund: - Here the fund holding lies majorly in Small cap stocks i.e. from 250 onwards.

» Multicap fund: - Here the fund manager has the flexibility to invest across all the three-market cap i.e. large cap, Mid cap and small cap.

» Dividend yield fund: - Here the fund invests in dividend yielding stocks from across the market caps.

» ELSS fund: - This is similar to a Multicap fund, the advantage here is that this fund gives tax benefit under section 80C of Income tax.

» Sector/Thematic fund: - Here the fund invests in stocks of a particular sector or theme outlined for ex a Pharma fund will invest in Pharma stocks, an Infrastructure fund will invest in Infrastructure stocks and so on.

» Value fund: - This fund also is a Multicap fund, but here the fund manager invests in stocks which he/she perceives to be undervalued based on their research.

» Contra Fund: - A contra fund is defined by its against-the-wind kind of investing style. The manager of a contra fund bets against the prevailing market trends by buying assets that are either under-performing or depressed at that point in time. This is done with the belief that the herd mentality followed by investors on the Street will lead to mispricing of assets, which will pick up steam in the long run, creating opportunities for investors to generate superlative returns.

» Index fund: - Here the fund replicates a particular index like Senses or Nifty. The investment will be in stocks held in the underlying index and in the proportion similar to the index (Proportion of stocks considered while calculating the Index).

» Fund of Funds: - As the name suggests, here the fund invests in a portfolio of other funds.

» ETF: - ETFs or exchange traded funds are similar to index mutual funds. However, they trade just like stocks. These funds are listed and can be brought and sold directly just like stocks. These funds track an Index.

C) By Management Strategy

» Active funds: - This type of funds have a lot of involvement of the fund manager. Here the fund manager is involved in buying and selling of securities to provide the desired returns over an above the benchmark. Almost all equity funds come under this category.

» Passive funds: - This type of funds have very low involvement of the fund manager. Funds like index funds will come under this category.

After understanding all the theory about mutual funds, the next step is to understand how to go about investing in them. In our next article we will cover about how to go about investing in mutual funds.