Click here to download P3 Financial Bulletin

Weekly Market Forecast: 9th July – 15th July 2018

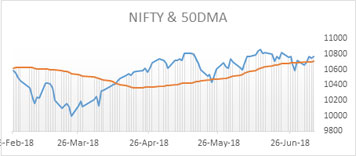

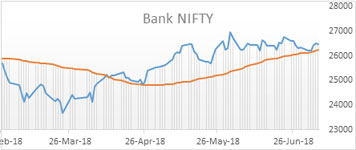

Indian market indices ended positive despite a volatile week. The NIFTY closed for the week at 10,772.65 (10,714.30 last week) up in green by 0.54%. The, BANK NIFTY also closed up at 26,493.85 (26,364.20 last week) a gain of 0.49%. BSE Midcap Index closed in RED for the fourth straight week, at 15,391.62 (15,450.90 last week). On the other hand, the BSE Small cap index closed positive, after hitting a 9-month low of 15,708.8, at 16,059.94 (16,032.15 last week).

The bullish trend continues at the broader market but with a caution as the US led trade war might be a dampener. Further, the Indian rupee continue to have a poor show against USD. Crude oil, too, has remained above USD 70 per barrel.

The US bourses rebounded after closing in red for three consecutive weeks. Dow closed at 24,464 (24,271.41 last week) up 0.79%. Both S&P 500 and NASDAQ followed Dow and closed at 2,762.5 (2,718.37 last week) and 7,231.25 (7,066.75 last week) respectively.

Volatility was seen in both Gold and silver prices. MCX Gold Mini futures closed at 30,582 (30,407 last week) up by 0.58%. MCX Silver Mini futures, on the other hand, closed marginally lower at 39,791 (39,945 last week) down by 0.39%.

Crude oil, after making sharp gains in last two weeks, ended flat. MCX Crude oil futures closed at 5,075 (5,089 last week).

The Indian Rupee depreciated further for the 5th week in a row. USD/INR closed at 68.9500 compared to last week’s 68.4700.

Events in the week:

- Tuesday 10 Jul – China CPI and New Loan data; US JOLTs Job Openings (May)

- Wednesday 11 Jul – China Caixin Services PMI (Jun); India M3 Money Supply; US OPEC monthly Report, PPI data, Crude oil inventories

- Thursday 12 Jul – India Industrial production (YoY May), CPI (YoY June); US Core CPI data (Jun), Unemployment rate (Jun), Fed Budget balance (Jun)

- Friday 13 Jul – China Export/Import and Trade Balance; India FX reserves & Trade balance; US Export/ Import price index, Michigan consumer Index and Inflation expectations

Trading Ideas: Based on technical analysis, we recommend the following trades for the week:

1. Maruti: Buy @ 8994.85; Stoploss 8917.90; Target 9148.90

2. Divis Lab: Sell @ 1090.45; Stoploss 1100.15; Target 1068.4

Last week’s Technical Call:

1. Dr. Reddy: Buy @ 2122.10; Stoploss 260.40; Target 2305.20…did not reach the price level (keep a watch)

2. Eicher Motors: Sell @ 29219.10; Stoploss 29780.55; Target 28090.55… did not reach the price level (keep a watch)

3. GAIL: Buy @ 321.15; Stoploss 314.70; Target 333.95…Target HIT

Credit- Dr Amiya Sahu

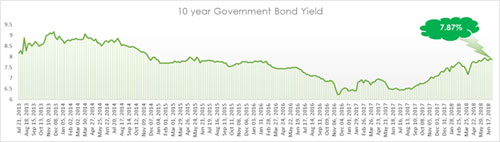

Bond market update

Bond yields fell by about 3 basis points (down by 0.42 %) during the week closing at 7.87% on renewed demand from corporates and banks.