Click here to download P3 Financial Bulletin

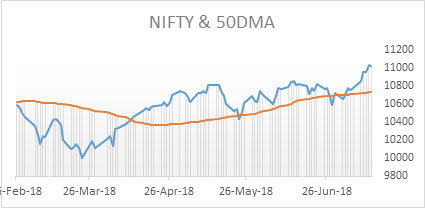

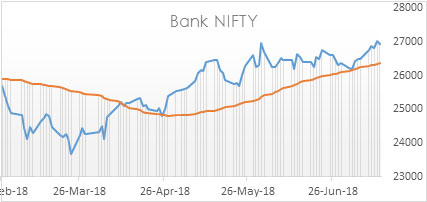

Weekly Market Forecast: 16th July – 22nd July 2018The Indian market made a strong positive move in the week. The NIFTY closed at 11018.9 (10772.65 last week) up by a whopping 2.29%. The, BANK NIFTY also closed stronger at 26935.95 (26493.85 last week) and gained 1.67%. Both BSE Midcap and Small cap indices also gained. Midcap Index closed at 15431.47 (15391.62 last week), BSE Small cap index also closed in green at 16196.33 (16059.94 last week).

The bullish trend continues of the broader market. The market direction will be driven by the first quarter results of Indian companies. The positive numbers of leader in IT sector (TCS & Infy) have pushed the stock prices of respective companies to all-time high levels. But, the performance of other sectors are expected to be weak. A watch on Indian data and global events is also crucial.

The US bourses made strong bulling move as they gained for the second week. Dow Jones Industrial Average (DOW) closed at 25019.41 (24,456.48 last week) up 2.30%. Both S&P 500 and NASDAQ followed Dow and closed at 2801.31 (2762.5 last week) and 7825.98 (7688.39 last week) respectively.

Both Gold and silver prices remain subdued. MCX Gold Mini futures closed at 30,150 (30,582 last week) down by 1.41%. MCX Silver Mini futures closed weaker than gold at 39,090 (39,791 last week) down by 1.76%.

Crude oil made a sharp correction in the week and was down by 3.31% compared to last week. MCX Crude oil futures closed at 4907 (5075 last week).

The Indian Rupee appreciated after losing for six weeks. USD/INR closed at 68.4950 compared to last week’s close of 68.9500.

Events in the week:

- Monday 16 Jul – China data on GDP, Industrial production, Retail Sales; India WPI inflation data; US data on Retail Sales, Business inventories

- Tuesday 17 Jul – US data on Industrial production

- Wednesday 18 Jul – India data on M3 Money supply; US data on Building permits, Crude oil inventories

- Thursday 19 Jul – US data on Initial Jobless claims, Philadelphia Fed Manufacturing Index

- Friday 20 Jul – OPEC meeting; India data on Bank loan/ deposit growth, Forex reserves

Trading Ideas: Based on technical analysis, we recommend the following trades for the week:

UPL: Sell @ 577.25; Stoploss 586.4, Target 558.85

Axis Bank: Buy @ 515.35; Stoploss 511.25, Target 523.55

Last week’s Technical Call:

1. Maruti: Buy @ 8994.85; Stoploss 8917.90; Target 9148.90

2. Divis Lab: Sell @ 1090.45; Stoploss 1100.15; Target 1068.4….stoploss triggered

Credit- Dr Amiya Sahu

Bond market update

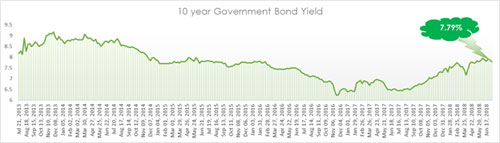

Bond yields retreated further in this week by about 8 basis points (down by 1 %) during the week closing at 7.79% on renewed demand from corporates and banks.

Investment Series 7: - How to go about Investing in Equity Mutual fund

In our earlier article we spoke about mutual funds, in this article let us understand about how to go about investing in them. For investing we are going to talk only with regards to investment as an individual. As we do in all other financial assets, before we start with investing in mutual funds one has to comply with what is known as Know your customer (KYC). Let’s understand it in detail in how to go about doing your KYC.

Know Your Customer (KYC)

There are two ways one can do KYC, either physically or electronically. In physical KYC one has to fill KYC form and attach a valid self-attested proof of Identity (POI) and Proof of address (POA). The documents which qualify as a valid POI and POA are mentioned on the instruction of KYC form. One has to note that PAN is mandatory for KYC if one wants to invest in mutual funds without any restriction, but if one doesn’t have a PAN one can still invest, in this case one can submit other valid documents as POI, but one should keep in mind that the limit for investment without PAN is Rs 50,000 per year.

The second way for doing KYC is electronically (e-KYC) using Aadhaar card. Here also there are two options (a) through Aadhaar OTP (b) through biometric. Here the condition as mentioned for PAN remains, post this the above condition applies. If one does through OTP then there is a limit for investing in mutual funds which is Rs 50,000 per year, but if done through biometric route there is no limit of that sort. When doing e-KYC there is no documentation involved and is completely paperless.

Selecting Scheme

One has to keep in mind that without KYC one will not be able to invest in mutual funds. Once the KYC process is completed one can start investing in mutual funds. A plethora of mutual funds schemes are available for investors to choose from based on their requirement and risk appetite. There are close to 42 AMCs selling schemes in almost all the categories discussed in our earlier article. If one is knowledgeable in the markets and knows how to analyze a mutual fund then he can do it by himself, otherwise one needs to contact a Investment advisor/Financial Planner/Mutual fund distributor for selection of the schemes.

Investment Plan

For mutual funds one can opt for either of the two plan (a) Regular and (b) Direct, which an individual can chose based on his knowledge and expertise in the markets and mutual fund products. The first option is Regular, here the investment in mutual funds is done through an AMFI (Association of Mutual funds in India) authorized mutual fund distributor. The distributor here not only acts as an intermediary between the investor and the mutual fund AMC (Asset management company) but also provides a load of value added services to the investor. Through the distributor an investor can get access to products from many AMCs at one place without much work. The value-added services offered range from carrying out basic services like Carrying out KYC, selection of the right fund, analyzing risk profile of investor, all the documentation work, delivery of documents to the AMCs, providing statements from time to time, portfolio tracking to a more advanced services like online platforms for paperless transaction with real time portfolio tracking, and advising on asset allocation strategies and valuable advice time to time based on the market performance. Some even offer other financial services like insurance, bonds/FDs, Income tax planning, Capital gain bonds, investment in stocks, Gold bonds etc. This option has a slightly higher expense ratio, the reason being the services of the distributor needs to be paid and hence the higher expense.

The second mode of investing which an investor can choose is direct, in this option the investor has to do all the value-added work being offered by the distributor all by himself/herself. If one has the knowledge, time and understands market well then one can go through this route. Most of the mutual fund AMC have their online platform from where one can invest through direct mode or else one has to go through the physical mode.

Once the investment plan has been decided, one can start investing in the choice of funds based on his goals, time horizon, and risk profile. While investing in equity mutual funds one comes across investment options.

Investment option

There are two investment options (a) Growth (b) Dividend. In a growth option the invested amount remains invested unless the investor chooses to redeem. Also, any dividends received from the stocks held by the fund are also invested back in the fund. In the second option, dividends are paid to the investor at regular intervals. This is suitable for investors who want regular cashflows. The taxation although is different for both. Although the former will come under the purview of Capital gains, the latter will also come under the purview of dividend distribution tax, one has to understand these implications before investing.

Amount of Investment

Once the plan is decided, one has the flexibility to either invest through lumpsum or through SIP/STP route. When we invest in mutual funds, the investor is allotted units. Units are purchased at a price which is called NAV. NAV is the net asset value of the fund arrived based on the securities it holds. In lumpsum mode, amount is put at one time to procure units in the mutual fund. One needs to put a min of Rs 5000 when investing through this route. Where as in SIP/STP mode an amount is put at regular intervals, one can start SIP/STP with a small amount of Rs 500 per month for most of the funds thus making it convenient for investing.

The above are the basic guidelines one needs to follow while investing in mutual funds. There are lot of other factors which one needs to see before selecting in mutual fund. For any further details one can get in touch with us or seek advise from any financial advisor before jumping on any decision of investing in mutual fund.