Click here to download P3 Financial Bulletin

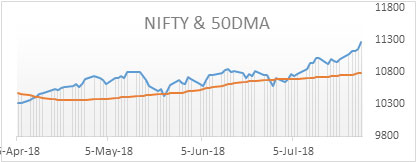

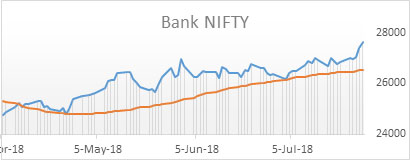

Weekly Market Forecast: 30th July – 5th August 2018 The Indians market scaled to a new all-time high in the week. The NIFTY closed at 11278.35 (11020.20 last week) up in green by a strong 2.44%. The BANK NIFTY, also closed at life-time high of 27634.40 (26873.20 last week) and strengthened by 2.83%. Both BSE Midcap and Smallcap made sharp gains too. Midcap Index closed at 15912.62 (15170.14 last week) with a gain of 4.9%. BSE Smallcap index closed at 16450.20 (15683.40 last week) with a gain of 4.9%.

The bullish trend continues of the broader market on a monthly basis. The market direction will continue to be driven by the first quarter results, as many companies will report their numbers. A caution is advised as the performance of manufacturing sector is expected to be weak. A watch on Indian macro data and global events is also crucial.

The US bourses were volatile. It gained with data on GDP numbers, but technology stocks, especially Facebook, pulled the indices down. Dow Jones Industrial Average (DOW) closed at 25451.06 (25058.12 last week) up by strong 1.57%. S&P 500 also closed in green at 2818.82 (2801.83 last week) up by 0.61%. However, NASDAQ ended in red for the week and closed at 7737.42 (7820.20 last week) down by a strong 2.79%.

Both Gold and silver prices continued to trade lower. MCX Gold Mini futures closed at 29,805 (29,950 last week) down by 0.48%. MCX Silver Mini futures closed weaker, too, at 38,360 (38,442 last week) down by 0.21%.

Crude oil ended flat, further to a sharp correction for last two weeks. MCX Crude oil futures closed at 4710 (4713 last week).

The Indian Rupee appreciated marginally for the week. USD/INR closed higher at 68.6550 compared to last week’s close of 68.7450.

Events in the week:

- Monday 30 Jul –US data on Pending Home Sales

- Tuesday 31 Jul – China data on Manufacturing PMI, Non-manufacturing PMI; India data on Fiscal deficit, Infrastructure Output; US data on Consumer Confidence, Employment Cost Index

- Wednesday 01 Aug –India Decision on Interest Rate, CRR; OPEC Meeting; US data on Non-farm Employment Change, Manufacturing PMI, Crude oil inventories, FED Interest rate decision

- Thursday 02 Aug – US data on Initial Jobless claims, Factory Orders

- Friday 03 Aug –China data on Services PMI, India data on Bank Growth, Deposit/ Loan growth, Forex reserves, USD data on exports & Imports, Manufacturing & non-farm Payrolls, Unemployment Rate, Manufacturing & non-manufacturing PMI

Trading Ideas: Based on technical analysis, we recommend the following trades for the week:

1. Reliance Capital: Buy @ 404.60; StopLoss 398.60; Target 416.60

2. India Cements: Buy @ 116.1; StopLoss 114.05; Target 120.20

3. Tata Motors: Sell @ 273.25; StopLoss 277.65; Target 260.15

Last week’s Technical Call:

1. Godrej Consumer: Buy @ 1263.20; StopLoss 1248.85; Target 1292.05…did not reach the level

2. Infosys: Buy @ 1321.30; StopLoss 1313.20; Target 1337.35…did not reach the level

3. Motherson Sumi: Sell @ 308.9; StopLoss 313.85; Target 294.05…missed entry by 1.2 rupees, Target HIT

Weekly Top Gainers/ Losers (NIFTY)

| Top Gainers | Top Losers | |||

| Sl No. | Name of Company | Weekly Return | Name of Company | Weekly Return |

| 1 | UPL | 15.63% | Baja Auto | 5.38% |

| 2 | ITC | 10.42% | Hero MotoCorp | 5.12% |

| 3 | ICICI Bank | 10.31% | Yes Bank | 4.27% |

| 4 | Indiabulls HF | 9.93% | HCL Tech | 3.58% |

| 5 | SBI | 9.66% | Wipro Ltd. | 3.00% |

Credit- Dr Amiya Sahu

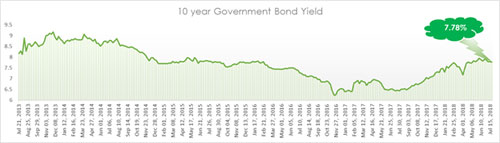

Bond market update

Bond yields remained flat for this week too, it moved lower by less than 1 basis points (down by 0.08 %) during the week closing at 7.78%.

RBI MPC meeting scheduled on 31st July-1st August, an important outcome of the meeting will be RBI stance on the interest rates. A rise in interest rates will push the bond prices lower and thus pushing the yields higher.

Investment Series 8: - Debt as an asset class

In our earlier articles we had discussed about equity as an asset class, from now for few weeks we will be discussing on the second asset class which is “Debt” or “Fixed Income”. Equity, as we know is about sharing the ownership of the enterprise which involves sharing the profits as well as losses made by the enterprise. But debt on the other hand as the word suggest is borrowing, here one doesn’t get a share of the ownership, here the investor offers loan to the enterprise/Govt/banks for which one earns interest, hence the word debt in this asset class. Also, as this asset provides investor with a fixed income in the form of interest the word fixed income is associated with it. This asset class carries lower risk then equity, simple reason being investor need not share the profits or losses. As this asset class involves borrowing by the enterprise/Govt/banks it is a liability for them, and any liability needs to be repaid first before benefits are passed to the shareholders. This can be simply explained with the fact that the profits generated by any organization are deducting the interest component on the borrowings, this ought to be paid first. Secondly, the volatility of the returns is very low as compared to that of equity and hence less chance of capital erosion.

In this article we will start discussing on the various investment options available for investors and how to go about investing in them. As there are many investment products, each article will consist information on minimum two products. In todays article let us start with the basic investment products which most of us will be aware about. All of us must have heard about the products like Fixed deposit, recurring deposit, lets understand something about them.

Fixed deposit

This instrument is offered predominantly by banks, but NBFC and companies also offer fixed deposits. This instrument offers fixed/guaranteed interest on the principal invested. Fixed deposits are loan given to an entity for its operation/expansion. Fixed deposit involves investing money in lumpsum and onetime for a duration selected, the money is received along with the interest one the deposit matures. The interest rate once defined, does not change till the maturity of the deposit.

Bank fixed deposits

The duration for fixed deposits range from 7 days to 10 years incase of banks. In order to open a fixed deposit, one has to normally have a savings bank account with the bank. Fixed deposits can be short-closed prematurely before the maturity but at a cost, banks normally deduct a penalty of approx. 0.5% to 1% from the interest. Banks offer higher interest rates for senior citizen (above 60 years) then others. Bank deposits do not have a rating, but riskiness can be compared only on the interest offered by them. So, a FD offering high interest will generally be riskier than the one with lower interest. By riskiness here I mean default risk. Banks borrow from retail investors in the form of FDs and then lend this money to corporate/retail clients. Risky loans have high interest rates as compared to the low risky ones, thus interest rates on FDs are based on the riskiness of these loans for which the funds will be used for. Now we can understand why some banks provide higher interest rates on fixed deposits as compared to others. Although most of us of are of the opinion that FDs are least risky, but one important point to keep in mind is bank fixed deposits are secured by Reserve Bank of India up to Rs. 1 lakh, which means that each depositor will get this sum if a bank goes bankrupt or does not pay back one's money.

Normally fixed deposits do not provide any tax benefit unless one invests specifically in tax saving deposits which have a lock in period of 5 years. This FDs with lock in period cannot be short closed till the lock in period is completed. One key point to note that whether you do a tax saving FD or a normal FD, the interest accrued is taxable.

In order to invest in a fixed deposit, one needs to approach the bank and fill the FD opening form. The form along with the amount needs to be handed over to the bank for opening the deposit account. Once the maturity is completed, the investor can extend the period, if the period is not extended then the matured amount is credited to the savings bank account. One can also open a FD with no paperwork through net banking channel.

Corporate fixed deposits

The duration of this fixed deposits ranges from 6 months-3 year. Corporate fixed deposits provide better returns than bank fixed deposits. Unlike banks, the FDs here can be analyzed based on their credit rating. Higher the rating, less risky is the investment. The risk as we have discussed above is not interest rate risk, but the default risk. The credit rating classifies the companies based on their default risk. AAA is the highest rating which can be achieved. A better rating one will give a lower return as compared to a lower rated one. Like bank FDs, corporate FDs also allow premature closure but with restriction like minimum lock in period of upto 6 months, penalty on premature closure.

In order to invest in corporate fixed deposit, one will have to get in touch with a broker. Most of the brokers have their online platforms from where one can invest in FDs once you have opened a demat/trading account with them. Before you start investing as we have seen in equity asset class the investor will need to comply with KYC.

Table below shows a crisp comparison between Bank and Corporate fixed deposits.

Table: - Comparison between BFD and CFD

| Bank fixed deposits | Corporate fixed deposits | |

| Offered by | Bank | Corporate Company |

| Rate of interest | Average | High |

| Tenure period | Ranges from months to years | 6 months to 3 years |

| Risk involved | Low | High |

| Medium of investment | Certificate of deposit | Certificate of deposit |

Recurring Deposit

Recurring deposit unlike fixed deposits involves investing on regular basis. This product is offered by the banks. The minimum duration is 6 months to a max of 10 years. One can choose to start a RD with Min Rs 10, the investment is made on a monthly basis till the time of maturity. The interest here is similar to a fixed deposit, but since the investment is on monthly basis as compared to a FD the absolute returns will be lower. This mode of investment creates a discipline of investing as there is a periodic outflow of cash from SB account to investment.

Like FD, RD also can be prematurely closed but with deduction of penalty by the banks. Important thing to note that the RD will mature one month after the deduction of the last installment. An Investor needs to pay tax from the returns earned out of the RD.

Some banks offer flexi RD where the amount of investment can be varied on monthly basis. The core amount is fixed and then one can invest in multiples of the core amount as per his requirement. This facility allows to invest more when a higher surplus is available with the investor.

In order to invest in a recurring deposit, one needs to approach the bank and fill the deposit opening form. The amount gets deducted automatically from the savings bank account on monthly basis till the maturity. Once matured the amount will automatically get credited in the savings bank account. One can also open a RD with no paperwork through net banking channel.