Click here to download P3 Financial Bulletin

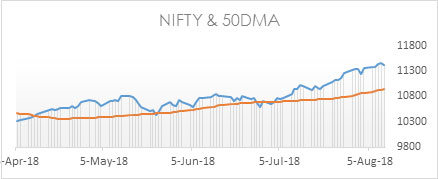

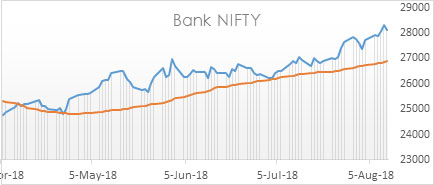

Weekly Market Forecast: 13th August to 19th August 2018 The Indians market scaled to a new all-time high again in the week but closed subdued on Friday. The NIFTY closed at 11429.5 (11360.80 last week) up in green by another 0.63% for the week. The BANK NIFTY also reached a new high and closed 28124.25 (27695.50 last week), strengthened by 1.55%. Both BSE Midcap and Smallcap closed restrained after clocking gains for last two weeks. Midcap Index closed at 16210.78 (16206.89 last week) with a very small gain of 0.02%, on the other hand BSE Smallcap index had a reversal in its green movement, closing at 16784.2 (16833.52 last week), a loss of 0.3%.

The bullish trend continues of the broader market as viewed on a monthly basis. A watch on Indian macro data and global events is also crucial.

The US bourses were volatile. Dow Jones Industrial Average (DOW) after a flat closing last week, ended in red this week closing at 25313.14 (25462.58 last week) down by 0.58%. S&P 500 also closed in red at 2833.28 (2840.35 last week) down by 0.25%. However, NASDAQ ended in green week and closed at 7839.11 (7812.02 last week) up by 0.35 %.

Both Gold and silver prices closed flat for the week. MCX Gold Mini 05 Sep futures closed at 29715 (29612 last week) up by 0.34%. MCX Silver Mini 31 Aug Futures closed at 38000 (38111 last week) down by 0.29%.

It was a volatile week for Crude oil price movements. MCX Crude oil 20 Aug Futures closed at 4673 (4690 last week) down 0.36%.

The Indian Rupee depreciated for the week. USD/INR closed higher at 68.8300 compared to last week’s close of 68.6200.

Events in the week:

- Monday 13 Aug – India data on CPI

- Tuesday 14 Aug – China data on Unemployment rate, Industrial production, Retail Sales; India data on WPI; US data on Export/ Import Price index,

- Wednesday 15 Aug – India Holiday; US data on Retail sales, Non-farm productivity, Industrial production, Crude oil inventories

- Thursday 16 Aug – US data on Building permits; Initial Jobless Claims; Philadelphia Manufacturing Index

- Friday 17 Aug – India data on Bank Loan/ Deposit growth, Forex; US Michigan Consumer Index

Trading Ideas: Based on technical analysis, we recommend the following trades for the week:

1. Tata Steel: Buy @ 562.55; StopLoss 557.80; Target 572.25

2. Tata Power: Sell @ 71.70; StopLoss 72.15; Target 70.80

3. Maruti: Buy 9012.15; StopLoss 8899.95; Target 9236.5

Last week’s Technical Call:

1. HDFC Bank: Buy @ 2085.30; StopLoss 2060.10; Target 2135.80…price level did not reach

2. BPCL: Sell @ 412.40; StopLoss 418.95; Target 392.70… price level did not reach

Weekly Top Gainers/ Losers (NIFTY)

| Top Gainers | Top Losers | |||

| Name of Company | Weekly Return | Name of Company | Weekly Return | |

| ICICI Bank | 7.74% | Lupin | - 8.64% | |

| Eicher Motors | 7.42% | GAIL | - 6.50% | |

| Axis Bank | 7.09% | Sun Pharma | - 5.44% | |

| Hindalco Industries | 5.25% | Adani Port | - 5.07% | |

| Bajaj Finance | 4.74% | India Bull Housing | - 3.82% | |

Credit- Dr Amiya Sahu

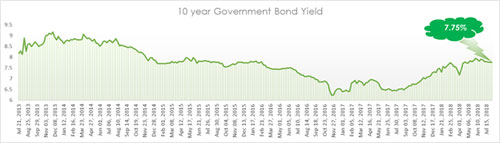

Bond market update

Bond yields retreated slightly this week, it moved lower by one basis points (down by 0.12 %) during the week closing at 7.75%.