Click here to download P3 Financial Bulletin

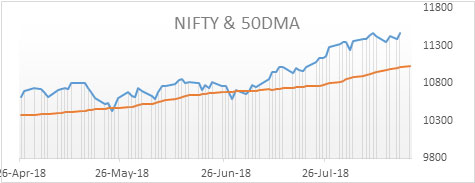

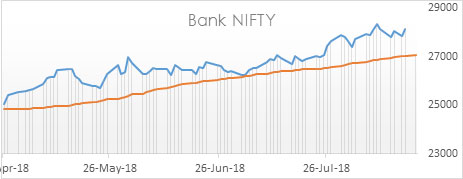

Weekly Market Forecast: 20th August to 26th August 2018 The Indians market scaled to a fresh all-time high, again in the week and closed in green. The NIFTY closed at 11470.75 (11429.5 last week) up by 0.36% for the week. The BANK NIFTY followed the trend reaching a new high, but the movement was flat at 28128.55 (28124.25 last week), up by just 0.02%. Both BSE Midcap and Smallcap followed market index. Midcap Index closed at 16306.44 (16210.78 last week) with a gain of 0.59%. BSE Smallcap index closed at 16866.32 (16784.2 last week) with a loss of 0.49%.

The bullish trend continues of the broader market on a monthly basis. A watch on Indian macro data and global events is very crucial.

The US bourses rebounded after early week volatility due to problems in Turkey. Dow Jones Industrial Average (DOW) closed at 25669.32 (25313.14 last week) stronger by 1.41%. S&P 500 also closed in green at 2850.13 (2833.28 last week) up by 0.59%. However, NASDAQ closed in red at 7816.33 (7839.11 last week) down by 0.29 %.

Both the shiny metals, Gold and Silver closed in red for the week. MCX Gold Mini 05 Sep Futures closed at 29,285 (29,612 last week) weaker by 1.45%. MCX Silver Mini 31 Aug Futures closed at 36,811 (38000 last week) down by 3.13%.

It was a volatile week, again, for Crude oil price movements. MCX Crude oil 20 Aug Futures closed at 4605 (4673 last week) down 1.45%.

The Indian Rupee depreciated further in the week. USD/INR closed higher at 69.9000 compared to last week’s close of 68.8900.

Events in the week:

- Tuesday 21 Aug – OPEC meeting;

- Wednesday 22 Aug – India Holiday; US data on Existing home sales, Crude oil inventories

- Thursday 23 Aug – US data on Initial Jobless Claims; Manufacturing & Services PMI, New Home Sales

- Friday 24 Aug – India data on Forex; US data on Core Durable Goods Order

Trading Ideas: Based on technical analysis, we recommend the following trades for the week:

1. Axis Bank: Buy @ 599.35; StopLoss 588.40; Target 621.30

2. GAIL: Buy @ 381.20; StopLoss 376.35; Target 390.95

3. Grasim: Sell @ 1042.55; StopLoss 1051.70; Target 1015.10

Last week’s Technical Call:

1. Tata Steel: Buy @ 562.55; StopLoss 557.80; Target 572.25…did not reach price level

2. Tata Power: Sell @ 71.70; StopLoss 72.15; Target 70.80…did not reach price level

3. Maruti: Buy 9012.15; StopLoss 8899.95; Target 9236.5…Target HIT

Weekly Top Gainers/ Losers (NIFTY)

| Top Gainers | Top Losers | |||

| Name of Company | Weekly Return | Name of Company | Weekly Return | |

| Sun pharma | 12.55% | Hind Pertol | - 6.50% | |

| Lupin | 8.87% | BPCL | - 5.98% | |

| Grasim | 7.67% | HDFC | - 4.49% | |

| GAIL | 6.82% | Indiabulls HF | - 4.38% | |

| Dr. Reddy’s | 6.77% | Indian Oil | - 4.09% | |

Credit- Dr Amiya Sahu

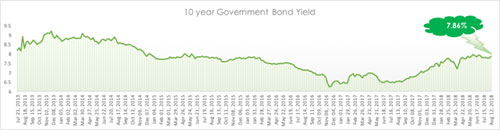

Bond market update

Bond yields reversed its trend this week, it moved upwards by ten basis points (up by 1.38 %) during the week closing at 7.86%. The rise in yields is on account of rupee depreciation touching 70-mark last week amid tensions in Turkey.

Investment Series 9: - Debt investment

In our previous article we initiated our discussion on the second asset class which is debt. We started with the fixed deposits and recurring deposit, which are considered the basic debt investment which most of us know about. Today we will again discuss on other debt investment which most of us again are aware. In this article let us understand about employee provident fund (EPF) and public provident fund (PPF).

Employee provident fund

PF is retirement benefit scheme applicable for all salaried employees. The fund is managed and overseen by Employee Provident Fund Organization (EPFO). All individuals make contribution to PF to the tune of 12% of their basic salary plus dearness allowance, if there is no dearness allowance (DA) then the PF calculation is completely on the basic salary. One important point to note is that in PF, your employer also contributes equally to the scheme for you i.e. 12% of basic plus DA is put in your name by the organization. But the entire PF amount contributed by the employer doesn’t go in the PF account, some of it goes to the employee pension scheme (EPS). Employee/Individual can further increase his PF contribution from the basic deduction of 12% through what is called voluntary provident fund. The investment in provident has few major benefits to investor

1) Disciplined monthly investment

2) Higher interest rates than FD/RD

3) Interest earned is tax exempt

4) Investment considered for benefit under 80C

The provident fund corpus can be partially withdrawn on the following reasons only.

1) House construction

2) Marriage of self/ son/ daughter

3) Medical treatment

4) Repayment of home loan

5) Repair works of house

6) Education purpose

7) Miscellaneous

Public Provident Fund (PPF)

PPF is an investment product mainly designed for a long term goal keeping in mind the safety of the capital invested. The PPF account can be opened at Post office, Nationalized banks and also in some private banks. In this scheme the investment ranges from min Rs 500 per year to a max of Rs 1,50,000 per year. The account once opened has a lock in period of 15 years, post completion of the 15 years further extension can be done in block of 5 years each. The interest rate on PPF investment is 7.6%.

The following are the benefits of PPF which are similar to EPF.

1) Higher interest rates than FD/RD

2) Interest earned is tax exempt

3) Investment considered for benefit under 80C

The amount in PPF can be withdrawn from 7th years onwards i.e. post completion of 6 years. An individual can withdraw 50% of the balance at the end of 4th year preceding the year in which the withdrawal is made or 50% of the amount at the end of preceding year whichever is lower.

In the above article we have tried to explain in brief the investment option EPF and PPF. Hope the same was useful. In our next article we will cover few other investment options.