Click here to download P3 Financial Bulletin

Weekly Market Forecast: 18th – 24th June 2018

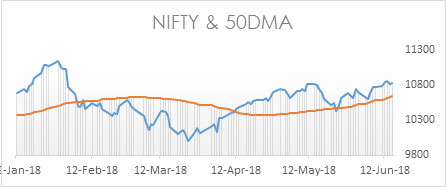

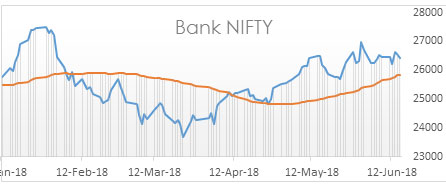

Indian broader market was in green in the first part of the week but reacted to the increase in US Fed rates. The NIFTY closed positive for the week at 10817.7 (Last week close10767.65) up by 0.46%. However, BANK NIFTY continued its weakness and ended in RED for the second week, It closed at 26417.40 (Last week close 26451.35) down by 0.13%. Both Midcap and Small cap reacted to the volatility and ended flat for the week. BSE Midcap Index closed in Green at 16001.20 (Last week close 16022.37) and the BSE Small cap index closed down at 16916.16 (Last week close 16887.13).

The bullish trend continues of the broader market with a caution as the interest rate hike in US might have a negative effect. In the coming week, market movement will be guided by Indian and global events.

The US bourses closed red for the week ending 15th June. Dow closed at 25090.48 (Last week close 25314.95) down 0.89%. Both S&P 500 and NASDAQ ended flat and closed at 2779.42 (Last week close 2779.03) and 7746.38 (Last week close 7645.51) respectively.

Volatility was seen in both Gold and Silver prices. Both the shiny metals corrected in the week, compared to last week’s gains. MCX Gold Mini futures closed at 30819 (Last week close 31085), down by 0.85%, MCX Silver Mini futures closed at 40216 (Last week close 40460) weaker by 0.90%.

Crude oil dropped marginally in the week. MCX Crude oil futures closed at 4432 (Last week close 4448) down by 0.36%.

This week, Indian Rupee depreciated against USD. USD/INR closed at 68.015 compared to last week’s 67.5115.

Events in the week:

- Monday 18 Jun – China holiday;

- Tuesday 19 Jun – US Housing Data (MoM for May)

- Wednesday 20 Jun – India M3 Money supply; US Existing Home Sales (May), Crude oil Inventories

- Thursday 21 Jun – US Philadelphia Fed Manufacturing Index (July) & Fed Employment rate (July)

- Friday 22 Jun – India Bank data: loan/ deposit growth, Forex reserves; US Manufacturing PMI (Jul), Services PMI (Jul), OPEC Meeting

Trading Ideas: Based on technical analysis, we recommend the following trades for the week:

1. Infosys: Buy @ 1249.85; Stop Loss 1239.95; Target 1270.60

2. HCL Tech: Buy @ 934.15; Stop Loss 930.65; Target 941.15

3. Reliance Ind: Buy @ 975.45; Stop Loss 958.95; Target1 1008.35, Target2 1025.15

Last week’s Technical Call:

1. Sun Pharma: Buy @ 494.20; Stop Loss 483.80; Target 514.90…did not reach this price level

2. Dr. Reddy’s: Sell @ 2057.80; Stop Loss 2074.50; Target 2007.50…stop loss triggered

3. Jet Airways: Sell @ 415.70; Stop Loss 423.50; Target 400.15… did not reach this price level

Credit- Dr Amiya Sahu

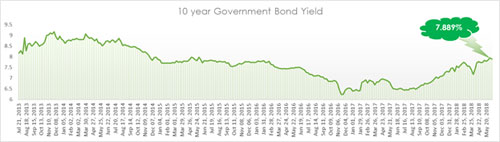

Bond market update

Bond yields fell by about 6 basis points (down by 0.73 %) during the week closing at 7.889%. The reduction in the yields were mainly on account of fall in oil prices last week.

The macroeconomic situation has been the reason for this rise in yields. The rise in oil prices has raised concerns about fiscal slippage. Also, inflationary condition has added to this and has caused RBI to increase rates by 0.25 basis points. Finally, the depreciation in the currency and rising yields in US markets have made many foreign investors to move out from the Indian market. If similar conditions continue, then we could expect further rate hikes from RBI in days to come.