Click here to download P3 Financial Bulletin

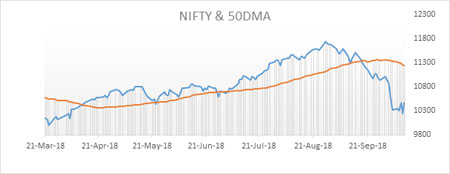

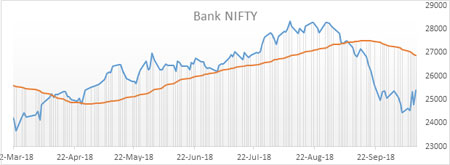

Weekly Market Forecast: 15th October to 21st October 2018 The Indians market rebounded after sharp cuts for five consecutive weeks. The NIFTY, closed in green for the week at 10472.50 (10316.45 last week) up by 1.51%. The BANK NIFTY, also rebounded and closed at 25395.85 (24443.45 last week), stronger by 3.90% for the week. Both BSE Midcap and BSE Smallcap followed the leading indices. Midcap Index closed at 14286.22 (14003.81 last week) with a gain of 2.02%. BSE Smallcap index closed at 14159.43 (13840.46 last week) up by 2.30%.

Market movements in this week will be primarily derived on second quarter results of some of the big companies. Last week TCS results was not as expected and market reacted negatively to it. The market indices are still in negative territory on a weekly basis. Key data on performance of US and Chinese markets also to be observed.

The US bourses were subdued for the 3rd straight week. Dow Jones Industrial Average (DOW) closed at 25339.99 (26447.05 last week) weaker by a whopping 4.30%. S&P 500 closed at 2767.13 (2885.57 last week) down by 4.10%. NASDAQ also closed in red at 7496.89 (7788.57 last week) weaker by 3.75%.

Mixed movement was seen in case of the shiny metals. MCX Gold Mini 05 November Futures closed at 31,655 (31,233 last week) stronger by 1.35%. MCX Silver Mini 30 Nov Futures closed at 38,933 (39,295 (38,610 last week) lower by 0.91%.

Crude oil price corrected in the week. MCX Crude oil 19 Oct Futures closed at 5254 (5542 last week) down by a strong 5.20%.

The Indian Rupee rebounded the week as USD depreciated against all major currencies. USD/INR traded above 74 mark on Monday and Tuesday but closed on Friday at 73.685 compared to last week’s close of 74.105.

Result Calendar

- Monday 15 Oct – Indusind Bank, Oberoi Realty

- Tuesday 16 Oct – ACC, Federal Bank, Infosys, Hero Motocorp, Mahindra CIE,

- Wednesday 17 Oct – Havells, Mindtree, Reliance Industries,

- Thursday 18 Oct – Mphasis

- Friday 19 Oct – HCL Tech, Untratech Cement

Events in the week:

- Monday 15 Oct – China FDI, New loans; India WPI data, Trade balance; US Core retail sales, Business inventories

- Tuesday 16 Oct– China CPI, PPI; US Industrial production, JOLTs Job Openings

- Wednesday 17 Oct – US Building permits, Housing statistics, Crude oil inventories,

- Thursday 18 Oct – India Holiday; US Philadelphia manufacturing index

- Friday 19 Oct – China GDP, Industrial production; US Existing home sales,

Trading Ideas: Based on technical analysis, we recommend the following trades for the week:

1. ITC: Buy @ 267.15; Stoploss 263.50; Target 275.10

2. SBI: Buy @ 246.60; Stoploss 239.25; Target 264.95

3. Sun Pharma: Buy @ 580.25; Stoploss 568.1; Target 616.65

Performance of Last week’s Technical Call:

1. SBI: Buy @ 246.60; Stoploss 239.25; Target 264.95…price level did not reach

2. Sun Pharma: Buy @ 580.25; Stoploss 568.1; Target 616.65…price level did not reach

Weekly Top Gainers/ Losers (NIFTY)

| Top Gainers | Top Losers | |||

| Name of Company | Weekly Return | Name of Company | Weekly Return | |

| TCSHPCL | 32.28% | Tata Motors | -15.03% | |

| Yes Bank | 19.64% | HCL | - 9.12% | |

| Indian Oil | 13.43% | TCS | - 8.77% | |

| Bajaj Finance | 13.05% | Vedanta | - 7.49% | |

| Eicher Motors | 12.80% | Infosys | - 6.32% | |

Credit- Dr Amiya Sahu

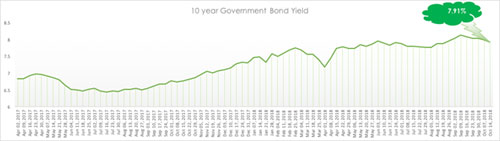

Bond market update

Bond yields are showing signs of retreat, it moved down by about 10 basis points (down by 1.4 %) during the past two week closing at 7.909%.

RBI last week purchased 120 billion worth of bonds in its OMO operation held on 11th Oct.