Click here to download P3 Financial Bulletin

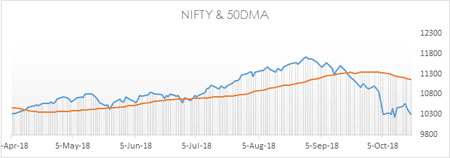

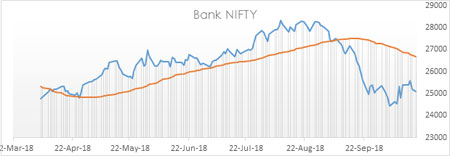

Weekly Market Forecast: 22nd October to 28th October 2018 The Indians market corrected again after last week’s bounce. The NIFTY, closed in red for the week at 10303.55 (10472.50 last week) down by 1.61%. The BANK NIFTY, also corrected and closed at 25085.80 (25395.85 last week), weaker by 1.22% for the week. Both BSE Midcap and BSE Smallcap followed the leading indices. Midcap Index closed at 14,058.30 (14,286.22 last week) with a loss of 1.60%. BSE Smallcap index closed at 14,082.92 (14159.43 last week) down by 0.54%.

The market reacted sharply over the second quarter results of biggies viz. Reliance Ind, HCL Tech, Ultratech Cements, Hero Motocorp, Infosys, ACC and IndusInd Bank. Movements in this week too will be primarily derived on second quarter results. The market indices are still in negative territory on a weekly basis. Key data on performance of US economy will have a strong influence on market.

The US bourses ended in green after three weeks of bearish move. Dow Jones Industrial Average (DOW) closed at 25444.34 (25339.99 last week) stronger by 0.41%. S&P 500 closed flat at 2767.78, almost at a same level as last week’s close of 2767.13. However, NASDAQ also closed in red for the week at 7449.03 (7496.89 last week) weaker by 0.64%.

Mixed movement was seen in case of the shiny metals. MCX Gold Mini 05 November Futures closed at 31754 (31,655 last week) stronger by 0.31%. MCX Silver Mini 30 Nov Futures closed at 38840 (38,933 last week) lower by 0.24%.

Crude oil price extended bearish move in the week after a steep fall last week. MCX Crude oil 16 Nov. Futures closed at 5087 (5243 last week) down by a strong 2.98%.

The Indian Rupee’s appreciation continued for the second week. USD/INR traded below 74 mark for most of the week. It closed on Friday at 73.3250 compared to last week’s close of 73.5650.

Result Calendar

- Monday 22 Oct – Asian Paints, GSK pharma, Hind Zinc, Kansai Nerolac

- Tuesday 23 Oct – Adani Port, Ambuja Cement, Bajaj Finance, Bajaj Finserv, TVS Motors,

- Wednesday 24 Oct – Baja Auto, Emami, Exide Ind, IDFC Bank, Jubilant Food, Kotak Mahindra Bank, L&T Fin Holdings, Wipro

- Thursday 25 Oct – Bharti Airtel, Biocon, JSW Steel, MRF, Piramal Enterprise, Yes Bank

- Friday 26 Oct – ICICI Bank, ITC, Indian Oil, Maruti Suzuki, Nestle

Events in the week:

- Monday 22 Oct – US T-bill auction

- Tuesday 23 Oct– US 2-year note auction

- Wednesday 24 Oct – India Money supply data; US Manufacturing PMI, Services PMI, New home sales, Crude oil inventories

- Thursday 25 Oct – US core durable goods order, Initial jobless claims, Pending home sales,

- Friday 26 Oct – India Bank loan/ deposit growth, Forex reserves; US GDP data, Michigan Consumer sentiments

Trading Ideas: Based on technical analysis, we recommend the following trades for the week:

1. HPCL: Sell @ 241.45; Stoploss 259.05; Target 189.05

2. Sun pharma: Buy @ 603.20; Stoploss 598.65; Target 612.30

3. Kotak Mahindra Bank: Buy @ 1181.60; StopLoss 1175.60; Target 1193.60

Performance of Last week’s Technical Call:

1. ITC: Buy @ 267.15; Stoploss 263.50; Target 275.10…Target HIT

2. SBI: Buy @ 246.60; Stoploss 239.25; Target 264.95…price level did not reach

3. Sun Pharma: Buy @ 580.25; Stoploss 568.1; Target 616.65…price level did not reach

Weekly Top Gainers/ Losers (NIFTY)

| Top Gainers | Top Losers | |||

| Name of Company | Weekly Return | Name of Company | Weekly Return | |

| ITC | 5.18% | Indiabulls Housing | - 29.85% | |

| Dr. Reddy’s | 4.16% | Yes Bank | - 11.58% | |

| Sun Pharma | 3.28% | Eicher Motor | - 9.53% | |

| Kotak Mahindra Bank | 2.72% | Maruti Suzuki | - 7.28% | |

| UPL | 2.61% | Bajaj Finserv | - 6.78% | |

Credit- Dr Amiya Sahu

Bond market update

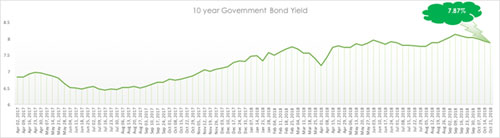

Bond yields are showing signs of retreat, it moved down by about 5 basis points (down by 0.62 %) during the past week closing at 7.87%.

RBI’s OMO operation along with softening of crude oil prices has triggered the reversal of bond yields. The 10-year bond yields have fallen 30 basis points since its peak of 8.23%. RBI has declared it would buy Rs 360 billion worth of bonds in the month of October. RBI has since July infused Rs 760 billion through OMO operation.