Click here to download P3 Financial Bulletin

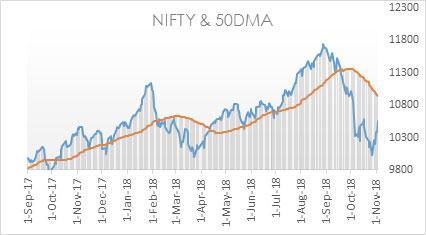

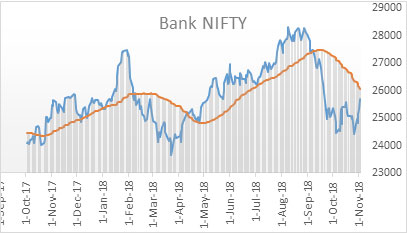

Weekly Market Forecast: 5th November to 11th November The Indians market made a good weekly bounce back from a 13 month low. The NIFTY, closed at 10,553 (10,030 last week) up by a strong 2.95%. The BANK NIFTY, also closed had a similar bounce back and closed at 25,701.65 (24,421.05 last week), stronger by 2.97% for the week. Both BSE Midcap and BSE Smallcap followed the leading indices. Midcap Index closed at 14888.73 (13,870.15 last week) with a staggering gain of 7.34%. BSE Smallcap index closed at 14,464.68 (13,597.64 last week) stronger by 6.38%.

The market reaction was influenced by the ease of tension seen on the trade war, fall in crude oil prices, rupee appreciation, and macro factors. Some of the leading NIFTY stocks moved up in the range of 15-20% in the week. Movements in this, curtailed, week too will be primarily derived on second quarter results. The market indices are still in negative territory on a weekly basis. Since US markets closed in red on Friday, Indian markets are likely to open in red on Monday. During the week, one may look at INFTY touching 10,425 for a positive move. Data on performance of US, China and other leading economies will have a strong influence on market. Investors should continue a watch on Crude prices and USD-INR exchange rate.

The US bourses turned green. Dow Jones Industrial Average (DOW) closed at 25,270.83 (24688.31 last week) stronger by a whopping 2.36%. S&P 500 closed at 2723.06 (2658.69 last week) up by 2.42%. NASDAQ too closed in green at 7356.99 (7167.21 last week) up by 2.65%.

The shiny metals closed mostly at level. MCX Gold Mini 05 November Futures closed at 31,737 (31,780 last week) weaker by 0.13%. MCX Silver Mini 30 Nov Futures closed at 38,653 (38,770 last week) lower by 0.31%.

Crude oil price extended bearish move for the fourth week. MCX Crude oil 16 Nov. Futures closed at 4615 (4953 last week) down by a strong 6.8%.

The Indian Rupee made a strong bounce back in the week. USD/INR closed on Friday at 72.4400 compared to last week’s close of 73.4400.

Result Calendar

- Monday 05 Nov – Bosch, Cipla, Divi’s Lab, Exide Industries, GAIL, Petronet, Powergrid, SBI

- Tuesday 06 Nov – Balakrishna Ind, Voltas

- Wednesday 07 Nov – Ashok Leyland, Britannia, UB

- Thursday 08 Nov – Aurobindo Pharma, Jindal Steel & Power, SAIL

- Friday 09 Nov – Bank of India, Titan, Tata Steel,

Events in the week:

- Monday 05 Nov – China Caixin services PMI; US Services PMI, ISM Non-manufacturing PMI,

- Tuesday 06 Nov – US JOLTs Job Opening, 10 Year note auction

- Wednesday 07 Nov – India Holiday; China FX reserves; US Crude oil inventories

- Thursday 08 Nov – India Holiday; China Export/ Import data; US Initial Jobless claims

- Friday 09 Nov – India Bank deposit/ loan growth, FX reserves data; China Inflation data, New loans data; US Fed Interest rate decision, PPI

Trading Ideas: Based on technical analysis, we recommend the following trades for the week:

1. TechM : Buy @ 693.00; StopLoss 669.60; Target 739.80

2. Bajaj Finance: Buy @ 2343.55; StopLoss 2327.05; Target 2376.60

Performance of Last week’s Technical Call:

1. ITC : Sell @ 294.8; StopLoss 300.75; Target 282.50…did not reach price level

Weekly Top Gainers/ Losers (NIFTY)

| Top Gainers | Top Losers | |||

| Name of Company | Weekly Return | Name of Company | Weekly Return | |

| Indiabulls HF | 27.34% | Coal India | - 6.95% | |

| Yes Bank | 15.72% | Kotak Mahindra Bank | - 2.19% | |

| SBI | 15.01% | Bharti Infratel | - 1.02% | |

| UPL | 14.25% | NTPC | - 0.82% | |

| Axis Bank | 13.57% | Wipro | - 0.69% | |

Monthly (October, 2018) Top Gainers/ Losers (NIFTY)

| Top Gainers | Top Losers | |||

| Name of Company | Weekly Return | Name of Company | Weekly Return | |

| UPL | 13.15% | Tata Motors | - 14.76% | |

| Titan | 12.14% | Grasim | - 11.64% | |

| ICICI Bank | 11.99% | ONGC | - 8.73% | |

| Hind Petro | 10.61% | Bharat Petro | - 8.70% | |

| Bajaj Finance | 9.37% | Indiabulls HF | - 8.35% | |

Credit- Dr Amiya Sahu

Bond market update

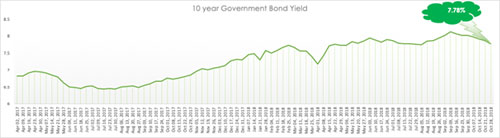

Bond yields cooled further in the week, it moved down by about 9 basis points (down by 1.22 %) during the past week closing at 7.78%. The bond yields have corrected by approx. 35 basis points since its peak in Sept’18.

The cooling of bond yields is mainly on account of falling oil prices thus easing inflationary and fiscal concerns.